Exploring prop trading platforms will reveal numerous

learning opportunities in Forex and Crypto markets. You’ll benefit from higher

profit potential and sophisticated tools. The Forex market has a daily trading

volume exceeding $6 trillion, requiring you to understand currency pair

dynamics and session influences. In the Crypto market, grasp the significance

of blockchain technology and market capitalization. Choosing the right firm

involves evaluating risk management strategies and profit sharing models. Effective

risk management, essential trading tools like MetaTrader 4, and rigorous

strategy development will enhance your trading acumen. Dig deeper to uncover

detailed insights for maximizing your potential.

What Is Prop Trading?

Prop trading, or proprietary trading, involves firms

investing their own capital in financial markets to directly generate profit,

rather than earning from client commissions. Originating in the 1980s, prop

trading has evolved significantly with technological advancements enabling

high-frequency trading and algorithmic strategies. Understanding the regulatory

landscape is crucial as rules vary by jurisdiction but generally focus on

ensuring market stability and transparency. For instance, the Volcker Rule under

the Dodd-Frank Act restricted prop trading by banks in the U.S. after the 2008

financial crisis, aiming to reduce risk and prevent conflicts of interest. In

Europe, the Markets in Financial Instruments Directive (MiFID II) imposes

stringent reporting and transparency standards on trading activities,

influencing how Prop Trading Platforms operate by emphasizing

compliance and robust risk management practices.

Benefits of Prop Trading

Prop trading offers significant advantages:

●

Higher

Profit Potential: By leveraging the firm’s capital, prop traders can

achieve returns up to 20% higher than typical retail traders.

●

Enhanced

Control Over Strategies: Prop traders enjoy autonomy to tailor trading

strategies, fostering deeper market understanding and sharpening

decision-making skills.

●

Access to

Advanced Tools: Prop trading firms provide access to sophisticated

analytics platforms, real-time data feeds, and risk management software,

enhancing trading efficiency.

●

Psychological

Resilience: The high-stakes environment cultivates resilience, teaching

traders to manage stress, adapt quickly to market changes, and maintain focus—a

critical skillset for long-term success.

Forex Market Basics

The forex market, boasting a daily trading volume

exceeding $6 trillion globally, revolves around currency pairs and distinct

trading sessions across major financial hubs.

Currency Pair Dynamics

Currency pairs like EUR/USD or GBP/JPY reflect the

relative value between two currencies, denoted by exchange rates. Fluctuations

in these rates are influenced by economic indicators, geopolitical events, and

market sentiment. Traders track these changes using tools such as moving

averages, Bollinger Bands, and the Relative Strength Index (RSI) to inform

their strategies.

Market Trading Sessions

The forex market operates continuously, segmented into

four primary trading sessions: Sydney, Tokyo, London, and New York. Each

session’s unique timing impacts market liquidity and volatility, with peak

activity during overlapping periods like the London-New York session overlap

from 1 PM to 4 PM GMT. Understanding these sessions helps traders optimize

trading strategies and manage risk effectively.

Mastering these fundamentals equips traders to navigate

the dynamic forex market with precision and confidence.

Crypto Market Fundamentals

Understanding the crypto market involves key

principles: blockchain technology, market capitalization, and trading volumes.

Blockchain Technology

Blockchain serves as the secure, decentralized ledger

for cryptocurrencies, ensuring transparent transactions across a network of

computers. This structure minimizes fraud risks and enhances trust among users.

Digital wallets are essential for storing and managing cryptocurrencies

securely.

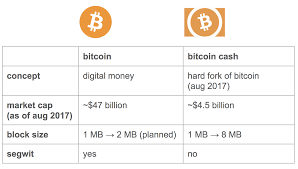

Market Capitalization

Market cap measures the scale and maturity of

cryptocurrencies, calculated by multiplying total supply by current price. High

market cap coins like Bitcoin and Ethereum tend to offer stability, while lower

cap alternatives may be riskier but potentially more rewarding.

Trading Volumes

Trading volumes reflect liquidity and interest in a

cryptocurrency. High volumes indicate active market participation and

contribute to accurate price discovery. Conversely, low volumes can lead to

higher volatility and less predictable price movements.

These fundamentals provide insights into navigating the

dynamic crypto market landscape effectively.

Choosing a Prop Trading Firm

Choosing a prop trading firm involves careful

evaluation of funding and capital allocation policies, risk management

strategies, and profit sharing models.

When assessing funding, consider the origin of

funds—whether internal, from external investors, or a combination.

Understanding equity allocation policies is crucial to foresee how much of your

earnings you can retain versus what the firm takes. Evaluate whether capital

allocations are fixed or performance-based, and ascertain if the firm offers

scalability options as your trading performance improves.

In terms of risk management, focus on the firm’s

position sizing guidelines and stop loss policies. Look for clear protocols

that limit your exposure per trade and enforce disciplined exit strategies to

mitigate potential losses. Assess whether the firm provides robust tools and

resources for real-time risk assessment and analytics, and seek out educational

support on effective risk management strategies.

Regarding profit sharing, examine the equity

distribution model—whether it’s a fixed percentage or tiered structure.

Understand the timing of profit allocations—whether they occur monthly,

quarterly, or upon reaching specific performance thresholds. Additionally,

clarify how the firm handles losses—whether they deduct losses from your equity

share or absorb initial losses up to a predefined limit.

Choosing the right prop trading firm involves weighing

these factors carefully to align with your trading objectives and maximize your

potential earnings in the Forex and crypto markets.

Risk Management Techniques

Effective risk management in prop trading involves

several key techniques to minimize losses and sustain profitability. Position

sizing is crucial, determining how much capital to allocate per trade based on

your risk tolerance. For example, risking 1% of your trading capital per trade

involves calculating the position size by dividing the dollar amount at risk by

the distance between your entry and stop loss points.

Stop losses are essential tools that automatically exit

positions when the market moves against you by a predefined amount. This

strategy helps mitigate emotional decision-making and limits potential losses,

aligning with data showing improved risk-adjusted returns with their consistent

use.

Diversification across asset classes, such as Forex and

crypto, is another vital technique. Analyzing historical volatility and

correlations between assets informs portfolio optimization, spreading risk more

effectively.

By implementing these disciplined risk management

techniques, prop traders can enhance their risk-adjusted returns, bolster

trading strategies, and sustain profitability over the long term.

Essential Trading Tools

Mastering risk management techniques is crucial, but

equipping yourself with essential trading tools further enhances

decision-making and execution efficiency. Charting software, like TradingView

and MetaTrader 4, offers real-time data visualization to pinpoint trends, price

movements, and entry/exit points in volatile Forex and crypto markets. These

platforms also provide customizable charts and extensive indicators.

Integrating backtesting tools into your toolkit is

equally essential. Platforms such as Amibroker and Forex Tester enable you to

test trading strategies against historical data without risking capital. This

process refines strategies, enhances predictive accuracy, and identifies

strengths and weaknesses, ensuring informed decision-making.

Both charting software and backtesting tools are

indispensable for maximizing efficiency and profitability in trading. They

establish the analytical foundation and practical insights necessary for

success in dynamic Forex and crypto markets. Mastering these tools

significantly enhances your trading experience and performance.

Strategy Development

Developing a strong trading strategy relies on

analyzing historical data, identifying patterns, and adapting to market

conditions with precision. Begin by gathering comprehensive historical data

relevant to your chosen Forex or crypto markets. This data serves as the basis

for backtesting, a crucial step in validating your strategy before live

trading.

Utilize software tools to simulate trades using

historical data, ensuring your strategy can handle diverse market scenarios.

Carefully select indicators that align with your trading objectives, such as

moving averages for trend analysis or the Relative Strength Index (RSI) for

identifying overbought or oversold conditions.

While combining multiple indicators can provide deeper

insights into market trends, avoid overfitting, which may yield unreliable

outcomes. Continuously refine your strategy by analyzing key performance

metrics like win rate, average return, and maximum drawdown. This data-driven

approach enables informed adjustments that strengthen your strategy over time.

Real-World Trading Experience

Once you’ve refined your strategy through rigorous

backtesting, gaining real-world trading experience is essential to validate its

effectiveness under live market conditions. Real-world trading introduces

variables like slippage, transaction costs, and emotional pressure, which

aren’t replicated in backtesting.

Mentorship programs can be invaluable at this stage,

offering insights from experienced traders to help navigate market nuances and

refine your strategy further. Developing psychological resilience is crucial in

real-world trading; studies show that managing emotions significantly improves

performance. Skills like stress management, discipline, and avoiding impulsive

decisions are essential for maintaining a consistent trading plan.

Additionally, prop trading platforms often provide

real-time analytics and performance reviews, allowing you to objectively assess

the effectiveness of your trades. Detailed reports can highlight areas for

improvement, such as timing of entries/exits and risk management strategies.

Conclusion

By delving into prop trading platforms, you’ll gain

invaluable experience in both forex and crypto markets. You’ll benefit from

thorough risk management techniques, essential trading tools, and strategic

development insights.

Evaluating prop trading firms carefully guarantees you

pick the right one to maximize your learning opportunities. Your analytical

approach will be honed through real-world trading experiences, enabling you to

make data-driven decisions.

Ultimately, this hands-on exposure will sharpen your

trading acumen, paving the way for future success.

2={\displaystyle x}

2={\displaystyle x} 3+7. Bitcoin has a proposed Bitcoin Improvement Proposal (BIP) that would add support for Schnorr signatures

3+7. Bitcoin has a proposed Bitcoin Improvement Proposal (BIP) that would add support for Schnorr signatures

You must be logged in to post a comment.