Foreign Exchange (forex or FX) is the trading of one currency for another. For example, one can swap the U.S. dollar for the euro. Foreign exchange transactions can take place on the foreign exchange market, also known as the forex market.

The forex market is the largest, most liquid market in the world, with trillions of dollars changing hands every day. There is no centralized location. Rather, the forex market is an electronic network of banks, brokers, institutions, and individual traders (mostly trading through brokers or banks).

Understanding Foreign Exchange

The market determines the value, also known as an exchange rate, of the majority of currencies. Foreign exchange can be as simple as changing one currency for another at a local bank. It can also involve trading currency on the foreign exchange market. For example, a trader is betting a central bank will ease or tighten monetary policy and that one currency will strengthen versus the other.In the forex market, currencies trade in lots, called micro, mini, and standard lots. A micro lot is 1,000 worth of a given currency, a mini lot is 10,000, and a standard lot is 100,000. This is different than when you go to a bank and want $450 exchanged for your trip. When trading in the electronic forex market, trades take place in set blocks of currency, but you can trade as many blocks as you like. For example, you can trade seven micro lots (7,000), three mini lots (30,000), or 75 standard lots (7,500,000).

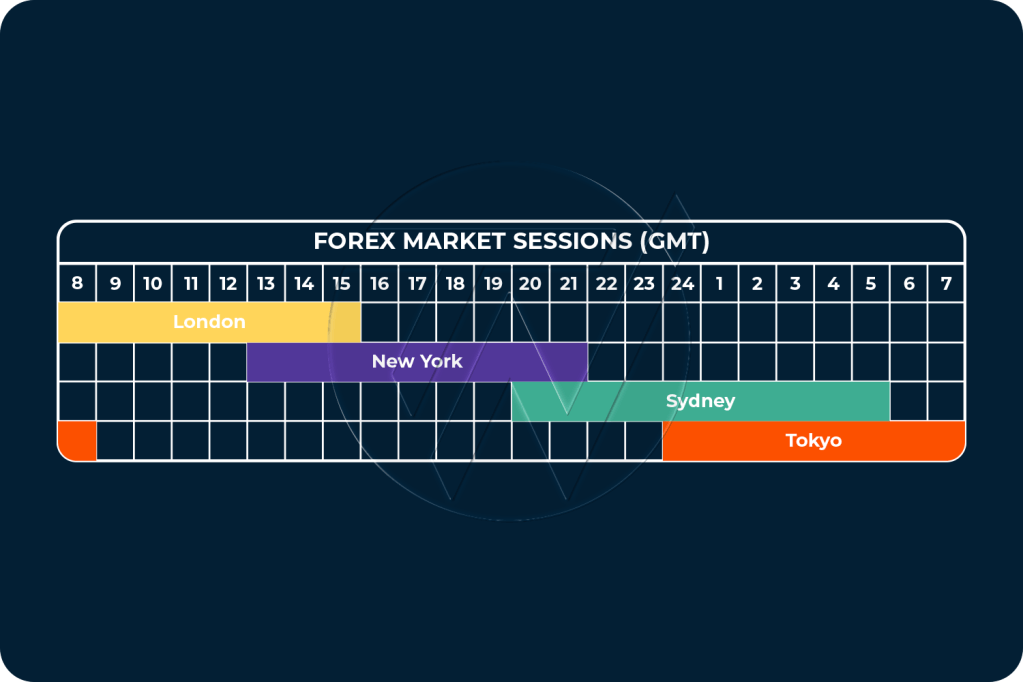

Images created and referenced from Trade Nation – What time does the forex market open. All distribution rights belong to the publisher and cannot be used without written permission.

The foreign exchange market is unique for several reasons, mainly because of its size. Trading volume in the forex market is generally very large. As an example, trading in foreign exchange markets averaged $6.6 trillion per day in April 2019, according to the Bank for International Settlements, which is owned by 63 central banks and is used to work in monetary and financial responsibility. The largest trading centers are London, New York, Singapore, Hong Kong, and Tokyo.

Trading in the Foreign Exchange Market

The market is open 24 hours a day, five days a week across major financial centers across the globe. This means that you can buy or sell currencies at any time during the day.

The foreign exchange market isn’t exactly a one-stop-shop. There are a whole variety of different avenues that an investor can go through in order to execute forex trades. You can go through different dealers or through different financial centers which use a host of electronic networks.

From a historical standpoint, foreign exchange was once a concept for governments, large companies, and hedge funds. But in today’s world, trading currencies is as easy as a click of a mouse—accessibility is not an issue, which means anyone can do it. Many investment companies offer the chance for individuals to open accounts and trade currencies however and whenever they choose.

When you’re making trades in the forex market, you’re basically buying or selling the currency of a particular country. But there’s no physical exchange of money from one hand to another. That’s contrary to what happens at a foreign exchange kiosk—think of a tourist visiting Times Square in New York City from Japan. They may be converting their (physical) yen to actual U.S. dollar cash (and may be charged a commission fee to do so) so they can spend their money while they’re traveling.

But in the world of electronic markets, traders are usually taking a position in a specific currency, with the hope that there will be some upward movement and strength in the currency that they’re buying (or weakness if they’re selling) so they can make a profit. Get the latest 1 US Dollar to Turkish Lira rate for FREE with the original Universal Currency Converter.

Differences in the Forex Markets

There are some fundamental differences between foreign exchange and other markets. First of all, there are fewer rules, which means investors aren’t held to as strict standards or regulations as those in the stock, futures, or options markets. That means there are no clearing houses and no central bodies that oversee the forex market.

Second, since trades don’t take place on a traditional exchange, you won’t find the same fees or commissions that you would on another market. Next, there’s no cutoff as to when you can and cannot trade. Because the market is open 24 hours a day, you can trade at any time of day. Finally, because it’s such a liquid market, you can get in and out whenever you want and you can buy as much currency as you can afford.

The Spot Market

Spot for most currencies is two business days; the major exception is the U.S. dollar versus the Canadian dollar, which settles on the next business day. Other pairs settle in two business days. During periods that have multiple holidays, such as Easter or Christmas, spot transactions can take as long as six days to settle. The price is established on the trade date, but money is exchanged on the value date.

Per an April 2019 foreign exchange report from the BIS, the U.S. dollar is the most actively traded currency.3 The most common pairs are the USD versus the euro, Japanese yen, British pound, and Australian dollar.4 Trading pairs that do not include the dollar are referred to as crosses. The most common crosses are the euro versus the pound and yen.

The spot market can be very volatile. Movement in the short term is dominated by technical trading, which focuses on direction and speed of movement. People who focus on technicals are often referred to as chartists. Long-term currency moves are driven by fundamental factors such as relative interest rates and economic growth.

The Forward Market

A forward trade is any trade that settles further in the future than spot. The forward price is a combination of the spot rate plus or minus forward points that represent the interest rate differential between the two currencies. Most have a maturity of less than a year in the future but longer is possible. Like with a spot, the price is set on the transaction date, but money is exchanged on the maturity date.

A forward contract is tailor-made to the requirements of the counterparties. They can be for any amount and settle on any date that is not a weekend or holiday in one of the countries.

The Futures Market

A futures transaction is similar to a forward in that it settles later than a spot deal, but is for standard size and settlement date and is traded on a commodities market. The exchange acts as the counterparty.

Example of Foreign Exchange

A trader thinks that the European Central Bank (ECB) will be easing its monetary policy in the coming months as the Eurozone’s economy slows. As a result, the trader bets that the euro will fall against the U.S. dollar and sells short €100,000 at an exchange rate of 1.15. Over the next several weeks the ECB signals that it may indeed ease its monetary policy. That causes the exchange rate for the euro to fall to 1.10 versus the dollar. It creates a profit for the trader of $5,000.

By shorting €100,000, the trader took in $115,000 for the short sale. When the euro fell, and the trader covered their short, it cost the trader only $110,000 to repurchase the currency. The difference between the money received on the short-sale and the buy to cover it is the profit. Had the euro strengthened versus the dollar, it would have resulted in a loss.

How Big Is the Foreign Exchange Market?

The foreign exchange market is extremely liquid and dwarfs, by a huge amount, the daily trading volume of the stock and bond markets. According to the latest triennial survey conducted by the Bank for International Settlements (BIS), trading in foreign exchange markets averaged $6.6 trillion per day in 2019.2 By contrast, the total notional value of U.S. equity markets on Dec. 31, 2021, was approximately $393 billion.5 The largest forex trading centers are London, New York, Singapore, Hong Kong, and Tokyo.

What Is Foreign Exchange Trading?

When you’re making trades in the forex market, you’re basically buying the currency of a particular country and simultaneously selling the currency of another country. But there’s no physical exchange of money from one hand to another. Traders are usually taking a position in a specific currency, with the hope that there will be some strength in the currency, relative to the other currency, that they’re buying (or weakness if they’re selling) so they can make a profit. In today’s world of electronic markets, trading currencies is as easy as a click of a mouse.

How Does Foreign Exchange Differ From Other Markets?

There are some fundamental differences between foreign exchange and other markets. There are no clearing houses and no central bodies to oversee the forex market which means investors aren’t held to the strict standards or regulations as those in the stock, futures, or options markets. Second, there aren’t the fees or commissions that exist for other markets that have traditional exchanges. There is no cutoff time for trading, aside from the weekend, so one can trade at any time of day. Finally, its liquidity lends to its ease of trading access.

You must be logged in to post a comment.