Peter Lynch is one of the most successful and top value investor of all time. He was a legendary fund manager who gave 29% returns to their investors for 13 years in a row. He wrote books on value investing , where he shared his investment lessons which he learned and used during his journey as an investor. He is one of the greatest value investor of all time. He is a firm believer that an average investor can also pick winning stocks as Wall Street professional with right research, patience , steady discipline and common sense.

Some of his investment principles are –

1. Invest in what you already know – “The worst thing you can do is invest in companies you know nothing about. Unfortunately buying stocks on ignorance is still a popular American pastime.” -Peter Lynch

People can perform well by investing in what they already know. For instance if a doctor wants to invest in banking sector (about which he know nothing) , he will not have that great return as compared to if he will invest in pharmaceutical companies ( as he already knew about drugs, healthcare sector and their companies)

“Invest in what you know. It leaves out the role of serious fundamental stock research. People buy a stock and they know nothing about it. That’s gambling and it’s not good.” -Peter Lynch

So, it’s better to choose the company whose products/services are either used by you or you are familier of the products/services of that company in some way or other. These knowledge will lead you to invest in better stocks .

2. Invest in companies not in stocks – “Look for small companies that are already profitable and have proven that their concept can be replicated. • Be suspicious of companies with growth rates of 50 to 100 percent a year”-Peter Lynch

Behind every stock there is a company. If companies will perform well, the stocks automatically will perform well. So, it’s important to know about the company, it’s business model. Choose a company whose fundamentals are strong. A company whose business model is so easy to understand that anyone can understand and run that company.

“Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it” -Peter Lynch

Know a companies management, it’s fundamentals and then ask yourself , “are you able to understand the mission and vision of the company? “ or “If you’ll be given the responsibility to run this company, will you be able to run the company? “

If the answers to the above questions are a YES then it’ll be great to invest in that company.

So always remember that you have to invest in a company and not in a single stock.

“Behind every stock is a company. Find out what it’s doing.” -Peter Lynch

“Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.”

3. Don’t take unnecessary risks. Take calculated risks – You don’t have to take risks which you can’t bear. Only take calculated risks.

Let’s say, you have $10 dollar, maybe if you will lost this, you won’t regret. But what if you lost $100 or $1000! Always buy stocks of the amount if you lose won’t regret. You are not required to put all your money in market and risk all that money. Instead put only that amount which if you lose won’t make you regret of investing.

Also, invest only the amount you will not need ever back in your life

4. Peter Lynch said that the most important thing that keep in mind while investing is : know why you own it.

“ You have to know what you own ,and why are you own it .” -Petrr Lynch

It sounds simple but it is not . He said when I asked most people they just don’t know why they own a stock . 80% of investors have no answer to this question .

They maybe hear some tip from anywhere and put their money at risk and when they lose it they blame institutions .

First you have to know the reason . Why you should invest in this company ,research about that company . Check their balance sheets . Without proper research you are not investing you are just gambling . Read and know as much as you can about the company. And remember to buy the company and not just a stock.

“If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand, and quickly enough so the fifth grader won’t get bored.” – Peter Lynch

5. Invest for long time- Lynch used to hold stocks for long period of time. He used to sell the stocks when the fundamentals of any company gets changed. This is his advice for all investors out there to not go behind short term profits but invest for a long period of time.

He even conducted many studies to understand the power of compounding.

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.”

Some more investment lessons by Peter Lynch :

• “Never invest in any idea you can’t illustrate with a crayon .”

• “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed”

• “Whenever you invest in any company, you’re looking for its market cap to rise. This can’t happen unless buyers are paying higher prices for the shares, making your investment more valuable.”

• “There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.”

• “Never invest in any company before you’ve done the homework on the company’s earnings prospects, financial condition, competitive position, etc”

• “Big companies have small moves, small companies have big moves.”

• “Good management, a strong balance sheet, and a sensible plan of action will overcome many obstacles, but when you’ve got weak management, a weak balance sheet, and a misguided plan of action, the greatest industry in the world won’t bail you out.”

• “In the long run, a portfolio of well chosen stocks and/or equity mutual funds will always outperform a portfolio of bonds or a money-market account. In the long run, a portfolio of poorly chosen stocks won’t outperform the money left under the mattress.”

This is how he succeed in the world of investment. You can learn from him and help yourself to reach the level you want in investment.

Thank you.

Tag: money

LAWS OF MONEY THAT WILL HELP YOU BUILD REAL WEALTH

1. Gold/Money clingeth to the protection of the cautious owner who invest it under the advice of men wise in its handling. Therefore while investing your money take the advice of a wise man.

2. Gold/Money sleeps away from the man who invest it in business or which are not approved by those skilled in its keeping simply don’t invest things unknown to you or first learn about them and then invest.

3. Gold/Money goes away from the man who would force it to impossible earning or who follows the alluring advice of tricksters and schemers or who trusts it to his own inexperience and romantic desires in investment

4. Gold/Money will come gladly and in increasing quantity to any man who will put by not less than one tenth of his earnings to create an estate for his future and that of his family.

WHAT IF 1RUPPEE IS EQUAL TO 1 DOLLAR ?

Before we get to that point we need to know the contrast between the two currencies. Dollar is considered as the strongest currency in the World. Each country in this World needs to have their cash as solid as Dollar since it is accepted that Stronger money = Stronger Economy. Be that as it may, is it in every case valid ? Since Countries like Japan and China have lower cash yet they are checked under nations with Strongest Economy.

So how is that conceivable that notwithstanding having the more fragile cash they have solid economy ? Fundamentally it relies upon , regardless of whether a nation is trade(export) orientated or import orientated ? The nations which purchases items or work from different nations are called import situated nations and these nations like to keep their money esteem higher so they can purchase merchandise from different nations at modest expense. Then again , nations which offer merchandise to different nations are called send out(export) orientated nations and these nations like to keep their cash esteem low so different nations purchase more and their creation builds which befits the economy. Nations like USA are import orientated while nations like China are trade orientated.

So what kind of nation is India is it import orientated or trade orientated ? India purchases products from different nations so it is significantly import orientated, yet larger part of India’s economy comes from exportation. India gives best specialists to I.T Sectors . At the point when organizations of different nations visit India they employ our people to work for them which consequently offers advantage to our economy. Numerous financial analyst accept that our economy ought to be more lower , while some accept that it ought to be higher.

PROS OF THE SITUATION:

*With more grounded rupee imports would be less expensive; you could now get the most recent iPhone for only 1000 INR. So everybody would claim an iPhone if 1 USD rises to 1 INR.

*Purchasing products from different nations in a global market will be less expensive which is advantageous for a non-industrial nation.

*Unrefined petroleum costs would go down significantly which we import the most, in this way the cost of petroleum and diesel will fall making the transportation cost modest if 1 USD approaches 1 INR.

*As the transportation cost would diminish the items that are made in India would be less expensive and effectively accessible to purchase.

*One would not travel abroad for a task. For instance, in the event that they get 3000$ abroad that will simply be equivalent to 3000 INR. So why bother voyaging? Yet, there is another side to it as well.

CONS OF THE SITUATION:

*Full stop on sends out we can trade merchandise due to the money contrast. The fares will become costly and on the off chance that we contrast Indian items if and other cutthroat nations, we will turn out to be far more costly and this will hamper our fares which isn’t useful for our economy.

*No unfamiliar venture: unfamiliar organizations put resources into India because of modest work now if an organization used to pay the laborer Rs20000 that is 300$ now they need to pay them 20000$ so they would begin putting resources into different nations as opposed to in our own if 1 USD approaches 1 INR.

*We will confront financial closure and expansion in joblessness for instance if my organization beneficiaries a designer from India for Rs75000 that is around 1000$ and if 1INR = 1 $ for what reason will I pay quite a lot more to the Indian specialist when I have choices. In this way, the Indian laborers need to deal with less expense or leave the work. The equivalent would occur with different callings too.

*In case they are chipping away at such a lot of lower compensation how might they pay their EMI? They proved unable. Joblessness will influence the banks as advances would be left neglected.

*We will confront financial log jam as cash would not be exchanged at a similar speed if 1 USD approaches 1 INR.

RESOUCES:

Greed vs Generosity: Which Gives a Better Competitive Advantage?

Many people think that in the professional world, selfishness and greed are the characteristics that pay dividends. But the truth is, excepting win-lose situations, that the most successful people in the medium and long term are those who are the most generous in their business and personal lives.

Ambition is a desire to take on more than you can realistically accomplish, to constantly strive for improvement, to grow both personally and professionally, and, of course, the desire to generate more income. However there comes a time when ambition crosses a line, and when that happens it becomes greed. Greed is the desire to chew more than you can eat, a desire that distracts you from realistically possible goals. Greed is wanting to get more than what you have actually earned, obtaining maximum profit at minimum cost, or as an old adage has it: “Grasp all, lose all.”

Today there is an abundance of courses and books on finance, limitless knowledge on hand with a simple click. But to know what is right, to subdue the pirates of greed and to follow your trading plan- this is another story. People who look for easy money invariably find that there is no such thing, paying a heavy price for this lesson. Ego, vanity, and revenge play a part, causing people to fail on their trading accounts. This is one of the factors that explains why people might not fall into the exclusive 10% that ‘win’, and find themselves one of the 90% that lose.

Literature and film are full of greedy and stingy characters, and the moral of films like ‘A Christmas Carol’ or ‘The Wolf of Wall Street’ is always the same: the fate of the greedy is heartbreaking. Their addiction to work means that they live a lonely life, and their search for wealth means that at the end of their lives, they have only the sober memory of their friends from the Stock Exchange.

GIVE AND TAKE

People do not realize that giving without expecting something in return could be a competitive advantage, as well as making ones outlook more positive. Studies have shown that the most successful people are generous. At least this is the affirmation of Adam Grant, a psychologist and professor at Wharton and author of “Give and Take”.

A generous person builds bigger and stronger networks, improves communication with their existing contacts, and also finds it easier to interact with people outside of their core network- this gives them access to new contacts and valuable sources of information. Generous people inspire in others a predisposition, or positive receptivity, to reconnect with them, as well as a greater willingness to collaborate.

Moreover, being a giver encourages persistence because givers are able to enthusiastically motivate people, inspiring confidence, because they are liberal with praise. They create a generally positive environment. Talent is important, but the most important factor in success is persistence. And what’s even more interesting is that being a giver has an energizing effect that increases levels of happiness.

According to Bill Williams, famous trader and writer of “Trading Chaos”, people with a ‘giving’ mindset enjoy more happiness and success. For example, later in his career Bill always traded two accounts, one for himself and one for his charities. The charity account always made more money, even though he traded using the same method with both accounts. In the charity account he never veered from his strategy, while in his own account he would sometimes take a trade based on a “feel”, or get in a trade before the actual signal. This shows us the importance of sticking to a plan, but also the importance of being a ‘giver’.

Giving distracts us from our problems, adds meaning to our lives and helps us feel valued by others. This explains why avidity and egoism are the trader’s worst enemy. Having a benevolent mindset while trading helps the trader to increase performance. Happy people earn more money on average, score higher yields, make better decisions and contribute more to their organizations. Furthermore, traders who are givers are at the top of the most successful trading operations.

THE GREED EFFECT

Focusing only on money results in the ‘greedy effect’, something that all professional traders know. In fact, one of the most common pieces of (rarely followed) advice that newbies receive is to shift their focus from trade results to the trading process, analyzing and following the rules of their trading system. Another suggestion is to start reasoning in pips and ticks instead of dollars. This reduces the greedy mindset and develops a more reliable attitude.

However we can make a further effort to improve our performance by shifting our focus to be more generous. One example is trading for charitable purposes like the aforementioned Bill Williams, another could be simply committing a small part of your monthly or annual profit to microcredits, which promote a world of stability and self-sufficiency, key to overcoming poverty.

Material things can be recovered, but feelings of guilt, helplessness and loneliness cannot be solved with money. If humans would be more understanding of and generous to others, the world would be a very different place. And that is why those who practice generosity, making it part of their daily lives, experience an uplifting of their mental and emotional state, and are generally filled with more satisfaction in their professional and personal lives.

In conclusion, we see that generous people are the most successful in their daily trading performance for the reasons described above. Having a giving mindset helps professionals become part of that exclusive group, the 10% of winners.

FUND TRANSFER: RTGS AND NEFT

RTGS

RTGS stands for Real Time Gross Settlement, which can be defined as the continuous (Real Time) settlement of funds individually or by order. Real Time means the processing of instructions at the time they are received rather than at some later time. “Gross Settlement” means the settlement of fund transfer instruction occurs individually.

RTGS system is generally meant for large value transactions as the minimum amount to be transfer through RTGS is Rs. 2,00,000. The maximum limit vary from bank to bank as there is no maximum limit specified by Reserve Bank Of India.

NEFT

NEFT stands for National Electronic Fund Transfer. NEFT is maintained by RBI and was started in November 2005. It is a national wide payment facility under which an individual can electronically transfer funds from any bank branch to any individual having an account with any other bank branch in the country. There is no minimum limit that can be transferred using NEFT. It is done through electronic means and can be availed through online banking or through ATM’s in some banks.

Advantages of NEFT

• The sender need not send the physical cheque or Demand Draft to the Beneficiary.

• The Beneficiary need not visit his his/her bank for depositing the paper instrument.

• Credit confirmation is send by message or E-mail

•A customer can use this facility from his home place by using the internet.

Difference between RTGS and NEFT

WHAT ARE THE CONTEMPORARY TRENDS IN THE VOTING BEHAVIOR OF THE INDIAN ELECTORATE

Studying about the voting pattern and election pattern of the world’s largest democracy is a challenge. India has seen a tremendous change in the voting pattern since the first elections of 1952. Election during that time was solely based on the leader and there was principal focus on only one political party but now the situations have changed. India has grown through the 21st century to see a lot of changes within the political system. Starting from the changes during the time of independence till today.

The voting pattern has seen considerable changes lately. During the time of independence the pattern of voting was solely based on the legacy of the nationalist movement. This was because people only voted for the single largest party at that time and that is the Indian National Congress. INC was people’s first choice since it had the legacy of the Independence struggle as well as it had an all India background which accommodated people from all kinds of religion and caste unlike other political parties which had its ground on only a single community of people.

While Today’s political system is quite complicated. The voting pattern has also become quite complex unlike earlier times. These days people’s voting pattern and behaviour have changed a lot. There are many factors for this change. It is quite a complex study where we have to unravel things from the core. For this we have to take a look from where this change in voting period has started from.

Till the 1977 elections congress party ruled India. The INC consecutively won the elections till 1977. Only to be defeated by the Janata Party. In 1989 INC was again defeated for the second time due to the unpopular rule of the congress and the lack of representation of the regional parties, lower or backward castes, minorities etc. 1989 put an end to the rule of single party system and welcomed in the multi-party coalition system in India.

Most striking trend in the Indian politics is the political competition between the Indian Political Parties that have grown past these years. This rise in the number of the political parties in India is due to the lack of representation of the various regionalities and communities. There has been a constant competition between various communities in the country for power. People are being voted mainly because they belong to a particular community or religion. This pattern of politics emerged only very recently within the country.

The behaviour of a voter in India is defined by the various factors

- Religion

- Caste

- Performance of the party in power

- Money

- Policy

The political parties make use of these factors to attract more voters. Although no party can convince a person to vote for them in the name of religion and caste, this is an important factor

In the elections. Since India is a secular country the political parties nor the government cannot have a tilt towards a single religion. Even still political parties use religion and caste to catch the polls.

RELIGION is one of the main factors which affect the voting behaviour these days in our country. People are more interested to elect for candidates to more or less belong to their same religion or community since they feel that then only they can identify themselves with the leader. Despite India being a secular country and the fact that no religious affiliations can be used in the election matters we can still see that people use the religious sentiments of the people to make use of their vote. Political campaigning’s are also done for the same. For an example the Bharatiya Janata Party (BJP) is the leading political party of India which is said to have the ideology of Hindutva. The party has a tilt towards the Hindu religion. Another example of a political party is the Indian Muslim League which is as the name says a Muslim political party.

The establishment of a secular state along with the freedom of religion – that is to choose to practise, profess and propagate any religion of our choice, treating all religions equally and not putting any religion one above the other , the political parties have failed to keep their word. Even after all these laws the use of religion in politics hasn’t come to and end and it seems like it never will according to the recent political activities and trends. The continued existence of political parties which are one way or the other linked with a religion is the main reason why religion cannot be put away from politics. The very existence of these religious acts as a black hole to the act of secularism in our country. The existence of religious pluralism affects the political system. The selection of a candidate is sometimes solely based on religions preferences. The religionization of socio- political issues by the political parties is one of the methods by which they continue to get the voters in their consideration.

CASTE is yet another important factor in determining the voting behaviour of the people. Caste has always had its root in all kinds of problems in India. Caste is an important determinant in the politics of India. It constitutes an important basis for social relations in the country. Despite the various measure taken stop the discrimination, caste still continues to an important basis for election. Politics in caste and caste in politics are very common in the Indian political scenario as we all know. Sometimes for the elections to various constituencies people are selected on the basis of their caste. Also while formulating various policies, election strategies and programme caste is taken as a major factor in the backdrop. Caste system has had its roots for years and so it will take a lot of time for people to weed out these roots even from the political scenario. Votes are brought in the name of caste by the candidates.

Caste is an important determinant for the selection of candidate for the rural population. Despite the various laws and the adoption of secularism, uneducated people mostly living in the rural India choose to vote for people who belong to their own caste. The candidates despite the laws in the country make use of their sentiments to seek vote for them. Although recently this trend has been changing at least in the urban households since as you go up the social ladder caste tends to be invisible. While in the rural areas caste tends to be an important factor in the selection of their leader.

PERFROMANCE OF THE PARTY IN POWER. The performance of the party already ruling is also another important determinant. Each political party comes into power with a election manifesto and various promises. After the elections it is their duty to fulfil all of this and meet the various aspirations of the people. And so the performance of the party during the time it rules is an important factor in determining whether the people should elect for the party next time too.

Improper ruling of the party during its tenure can result in it being not chosen for the next time. The way the party rules influences the people in a big way. We can see an example of this by looking at the example of the elections during 1989. The parties which got elected only stayed in power for a short period of time due to their political instability and the lack of a charismatic leader during the time of ruling. Their unpopular rule with the lack of ideology since it was a coalition lead the people to choose another political party.

MONEY influences people in different ways. Usually people with money and power tend to stay in high positions and rule the people according to their wishes. India is a developing country and most of people live under the poverty line. And so the people having money and power tend to rise to the top. Without other factors like political wave getting involved usually it’s the people with money and power who wins the elections. Rich and the powerful throw around the money to catch the ballot. But this is not always true though because in the 1989 elections congress used a lot of money and power but it couldn’t win the elections. BJP won the elections.

POLICY. Various policies taken by the government or the political parties stand out as an important deciding factor in elections by a common man. When a party announces its political manifesto the policies it takes for the people is an important determinant in voting. A person who doesn’t know much about politics and party tends to take a look at the policies of the party or what it has done in the past years. And so creating a policy that attract the crowd and implementing it in a proper way is important for any party.

These are the various trends which are seen across the country during the election time. The voters turnout has consistently increased from the time of independence till today. People has started to see election as an important way of choosing their leaders. As people are getting educated they started to look into the doings of the party and make a proper decision when it comes to who to vote for. Voting behavior is a form of electoral behavior and understanding it can help us understand how and why people choose to vote for certain people. And the above study was about voting behavior and its determinants.

COST

Cost refers to the expenditure incurred by a producer on factor as well as non-factor inputs for given output of a commodity. It can be categorized into explicit ( Opportunity cost of hiring inputs from the market, measured in cash payments that firm make to others.) and implicit costs. ( Opportunity cost of using self-owned inputs, measured in terms of imputed costs of self owned resources.). It is also termed as selling ( expenditure caused due to promote sale of good.) and production costs ( expenditure on inputs to produce an output.)

Fixed costs are costs related to use of fixed factor of production in short period like, machines, license fee, land expenditure, etc. They do not change with change in output. Variable costs on other hand refer to expenditure by producer on use of variable factors of production like, costs of raw material, wages of workers, wear and tear expense, etc. They increase with increase in output and vice-versa. Graphical representation is given by-

Total cost is defined as sum of variable and fixed costs. Since total variable cost tends to increase at diminishing rate initially, meaning that less and less of additional cost is incurred in every additional output. This happens due to increasing return to a factor and eventually TVC increases at an increasing rate.

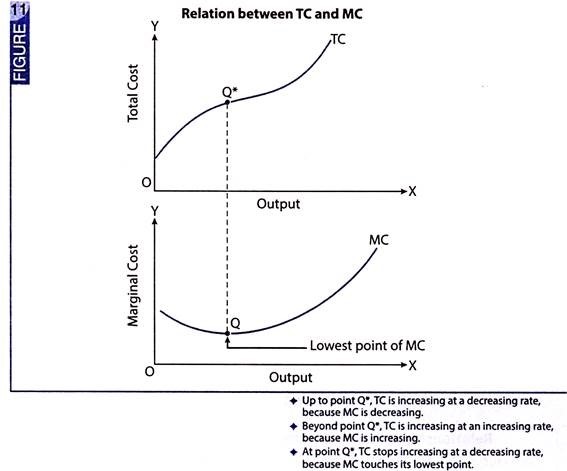

Relationship between TVC and MC:

i) Marginal cost is estimated as the difference between total costs of two successive units of output. Thus,

MCn = TCn – TCn-1

(ii) When MC is diminishing, TC increases at a diminishing rate.

(iii) When MC is rising, TC increases at an increasing rate.

(iv) When MC reaches its lowest point (point Q in Fig. 11), TC stops increasing at a decreasing rate (point Q* in Fig. 11).

Briefly, MC is the rate of TC.

ACCOUNTING

Accounting is used to keep a record of all transactions in the business. The accounting process includes summarizing, analyzing and reporting these transactions to oversight agencies, regulators and tax collection entities. It helps to handle all the documentation at a particular place. Accounting is a necessary function for decision making, cost planning, and measurement of economic performance measurement. Accounting process help to derive inference about the profit and loss transactions of the business. Accounting also helps organizations to plan their finances by developing budgets and forecasts.

CLASSIFICATION OF ACCOUNTING- i) Financial Accounting: This process help to develop the balanced sheets of a firm i.e. the net cash flow during a particular time period. These sheets are also called financial statements. This is important to develop by every organisation operating as it help to know the requirement of loan and net profits as a whole.

ii) Cost Accounting: It help to track down the production cost of the commodity on large scale. The difference between financial and coast accounting is that; In cost accounting, money is cast as an economic factor in production, whereas in financial accounting, money is considered to be a measure of a company’s economic performance.

iii) Managerial Accounting: A managerial accountant must be careful in communicating confidential information and to whom. They work with their managers to analyze and create a budget to meet the needs of the short and long-term goals of the organization.

iv) Tax accounting: As the name suggest, it help to track the annual tax reports to be given as income tax. This helps to reduce tax burden on the firm.

v) Public accounting: Public accounting refers to businesses that provide accounting advice to clients based on their needs. They can work in auditing, assist with tax returns, consult on procedures tailored to the installation of technology or computer programs and provide legal advice.

ACCOUNTING CYCLE- The summoning of all type of accounting gives us what we called an accounting cycle. It help the organisation to establish a system of check and balances.The sequence of steps starts when a transaction occurs and ends with its entry in financial reporting.

To have a successful business having a crucial knowledge of accounting is necessary.

Cashless Economy – Boon and Bane ?

What is a Cashless Economy ?

In a cashless economy most of the transaction will be done by digital means like e banking, debit and credit cards, PoS (point of sales) machines, digital wallets etc. In simpler words no liquid money or paper currency will be used by the people in a given country. In a cashless economy the third party will be in possession of your money. He will allow you to transact that money whenever it is needed. If it is not needed then the third party can use that money. Third party can be a government or any other public or private sector bank.

Positive Impact on Society

We are seeing the impact of cashless economy on the society when it comes to crime rates. According to Union defense minister after demonetization the crime rates in Mumbai has dropped to half. Not just Mumbai but Delhi is seeing a substantial decline in crimes related to financial motive. Bank robbery, burglary, extortion etc are declining because of demonetization.

Attack on Parallel Economy

This is one of the most important reasons why a cashless society is must. People who hoard money under their bed (also known as black money), people who launder money bypassing banking channels, terrorist who need money to finance their terror etc will run out of business now. Size of Parallel economy will reduce substantially.

Financial Inclusion

Digital economy will help to enhance our current banking system. There will be increased access to credit for people who did not fall in any banking network. Financial inclusion will automatically reduce poverty.

Increase the Tax Net

All the transactions that are done can be monitored and traced back to a given individual. If officials from tax department smell something fishy then they can trace the money transaction back to the individual. Hence it will be really difficult for someone to evade tax. Increasing tax net is very important for any government.

Boost in Consumption

There would be no incentive for people keeping money in the bank. So they would love to spend on things that they like. It will help to boost consumption that is really good for any economy. More jobs will be created and income level of people will rise.

Security and Convenience

Last but not the least is security and convenience. You don’t have to carry a wallet with money in it. You just use your mobile phone or credit card for transaction. It is very hassle free and already going on in urban areas of the country.

Security – Cyber Attack, Fraud and Power Outages

Cashless economy can be a nightmare when it comes to security. All your transactions will be done digitally. You will be prone to cyber attacks like hacking. Hackers can hack your sensitive information like password, credit card number etc and leave your account with no money. Even your personal computer is compromised. You can save yourself from fraud but it is very difficult to save from a cyber attack. Finally if there is a power outage especially in India which is very regular then entire system will be affected for long time.

Have to Trust Government or Third party

As I said earlier there is no money in your hand. All the money is digital so either they are in control of banks or government or any other third party. You have to trust government or bank blindly because everything is under their possession. This is could be scary because if tomorrow something happens you will be left with no hard cash.

Reduced Liquidity means Bad for Certain Sectors

There are certain sectors which depend upon high level of transaction. Sectors like Real Estate, jewelry, retail industry, restaurants and eating joints, cement and other SME will be affected badly because of cashless society. It means a lot people who are employed by these sectors are also going to be affected.

Really Bad for Poor

This is the real point and will be debating this in great details in following paragraph. Here I just want to say cashless economy is really going to hurt poor.

Money is probably the most significant invention in the history of economics which has now by and large fully replaced the barter system of trade across the world. However, nowadays, many developed societies in the world have now moved a step further by moving on to the cashless economy. In the developing countries like India, the cashless system has started making the inroads but it is far less in use than that of the developed counterparts.

During the pre-demonetization, the cash to GDP ratio in the country was between 12-13% of the GDP which fell to 7.3% during the demonetization. It was less than that of US where cash GDP ratio is at 7.8%. Though Reserve Bank of India (RBI) has started replenishing the cash into the economy but many experts believe that cash-GDP will not raise to the pre-demonetization level as government is giving a push to the cashless economy.

As India moves towards a cashless economy, following advantages are expected to accrue :

- The electronic payment will help the entrepreneur to increase their customer base and breach the geographical limitations.

- It is not necessary to be physically present to conduct cashless transaction. There is also no limitation on timing of transaction as it can be done at any time and from anywhere.

- Carrying high amount of cash is always a security hazard. For other modes like credit/ debit cards, in the event of loss or robbery, one can block the card. It may also reduce pick pocketing and highway robbery.

- Increasing share of cashless will improve government revenue as online transaction lead a trail of events which can be traced to find out tax evasion if any.

- Since the cashless transactions are more visible, it will help in curbing the clack money.

- If subsidy or wages for the welfare schemes like MNREGA are paid online through bank transfer instead of cash, it would also help in plugging the leakages and help in ensuring that subsidies are better targeted.

- As the people increasingly started using cashless transactions, it will help in increasing the tax base. It will be easy for the public as well to explain the tax authorities their past expenditure.

- Being cashless also inculcates budget discipline.

- It will also be easy to ward off the borrowers if you are cashless.

- Cashless transactions do away with the need of change. One can pay in exact amount even in fraction of rupee or paisa through card payment or online transaction.

- Problem of counterfeit currency will also be reduced in online transactions.

- One can also trace the funding of terror activities as online transactions leave a trail.

- There is high cost of printing currency notes. Switching to cashless transactions will decrease this cost.

However, being cashless has its share of disadvantages too :

- The biggest fear is the risk of identity theft. One can also become a victim of phishing trap.

- In case of loss or theft of card, getting another card is time consuming process.

- Since mobile phone had become an important element of cashless economy, loss of phone may become a double whammy as many financial details can be retrieved from it.

- If we take into account the proportion of non-tech-savvy population, the practical implementation of cashless economy will take enormous efforts.

Despite its drawbacks, the cashless system is indeed an improvement over the traditional cash based system. However, none of the advanced economy has fully replaced the cash as it is practically not possible but reducing the amount of cash and increasing the cashless transactions will definitely improve the transparency in business transactions and therefore is good for the country and economy.

Success

In today’s world everyone wants to be successful but what is a success. The perspective of success varies from person to person. For the record, the people before us have a different view on success and the person after us will have a different view on success. Moreover, people compare different people performance to evaluate their success. But success is not something that you can copy from others. You have to make your own path to achieving success. In modern-day, people are obsessed with success because of the glamour and lifestyle of successful people.

What formulates a person successful?

There are many ways in the world to be successful. But most people think of celebrities, artist, politicians, and businessmen whenever they heard the word success. Moreover, they think doing what they will make you successful but that not the case. They forget the most basic thing that makes a person successful that is their hard work, dedication, and the desire to achieve their dream. More importantly, they what they like to do not what that others told them to do. Successful people do what they like to do also they do what they feel correct for their business. If you look in the dictionary for the meaning of the word success then you will find that it means the achievement of one’s goal or aim. So, basically, anyone can achieve success by simply achieving their aim or goal.

What is the harm of success?

We all knew that we can’t achieve something without sacrificing something. Success also demands various things from you. But these sacrifices will not go in vain if you achieve your goal.

Certainly, many people achieve professional success but in doing so they fail in achieving mental, social and physical success. The tension of lacking behind in other things pulls them apart.

Also, there are cases where people became so obsessed with success that the people around them start to feel uncomfortable around them. In some cases, they have gone mad. Apart from that, people also get depressed if they can’t achieve success like others. So, we can say that there is much harm to success.

Success and hard work

It may sound unfit to some peoples but success depends a lot of hard work. Without it, you can’t become successful. Hard work does not mean that you do laborious work or the work that make you sweat. Hard work means having a healthy body, strong mind, willpower and positive attitude towards things. And for all those things you need energy. So, be attentive to your body and soul. Besides, do not just work on your program, push your limit, take charge of other things, improve your skills and most importantly keep learning. Apart from that, be with positive peoples, develop positive habits, and do exercise not only for the body but also for your mind.

To sum it up, we can say that success is like a seed that needs a balanced proportion of all the elements of life. And no one can achieve success in a day they have to go through and face different conditions in life for being successful. Above all, success is the feeling of fulfillment that you feel when you achieve your goal.

How to Become Rich Faster than Others (Practical Steps)

Everybody wants to become RICH one day.

Still, how is it that some people have all the answers? How do the rich keeping getting richer while the poor keep getting poorer? Is the game actually rigged against us? Are we, in fact, doomed to live ordinary lives, merely controlled by our hedonistic desires and pleasures, forced to succumb to our animalistic urges, never able to actually get ahead in life, let alone get rich? Or, is there some solution? A way out, if you will?

Clearly, these are questions posed by the masses. But not everyone can pull it off. What separates those who seem to have all the answers from those that are constantly jumping from one ship to the next, never able to truly find their gravy train? Well, the answers are far simpler than most would imagine.

Don’t spend more money than you make.

Not many people follow this advice. Many are focused on spending as much as possible. Whether it’s to revel in the perception of being more well-off than they actually are, or some other purpose, this is the truth across much of the developed world.

Keep a Diary of your Expenses.

Benjamin Franklin once said, “Beware of little expenses. A small leak will sink a great ship.”

As easy as it might seem to ignore the little stuff, so to speak, the more you sweat the details, the better off you’ll be. Cancel that gym membership you haven’t used in six months. Eliminate that costly cable television plan. Stop buying expensive lattes and eating out when you know you can’t afford to do it. Download an app or purchase a small notebook and track every expense no matter how small or how big.

Quit all the Bad Habits- drinking, smoking, gambling, etc.

Bad habits hold us back from achieving many kinds of goals. They stop us from losing weight, making more money, saving, investing and everything in between. The only way you can actually get ahead in life is to decimate those bad habits. You need to quit the bad habits before they lead you down a deathly spiral.

It’s hard to achieve something that takes so much of your energy, such as getting rich, without eliminating your bad habits first. I’m not just talking about poor financial habits; I’m also talking about any other habit that eats away at you, physically, emotionally or mentally.

Save 20 % of your Income every Month.

In order to get rich, you need to save at least 20 percent of your income off the top. Everyone has heard this before, but how many people actually follow this advice?

The term “pay yourself first” holds major weight here. While some don’t find the importance in this, others realize that this not only provides a rainy-day fund in case of emergencies, but also moment-of-the-opportunity cash. When the right opportunity comes by, you need cash to seize it. If you don’t have the cash, you just missed the proverbial boat.

Pay-Off your Debts.

When you’re debt-free from the bad debt (not the good debt like mortgages for investment properties and loans to grow you business, for example), take that money and put it towards your savings. The trick is not to go spending cash and splurging on a vacation or a new car once you’re debt-free. Stay focused.

Don’t Rent but Own your House.

No matter what it takes, even if you have to downgrade your living situation, you should do what it takes to purchase a home. Sit down with a mortgage broker and assess your situation. Set some goals and create a plan of action.

Even if you don’t have enough money saved for a down payment right now, figure out what it’s going to take to buy your home. We’re not talking about your dream home here. However, over time, the money spent on your mortgage is far better invested than money spent paying rent.

Invest, but only after Researching the hell out of it.

Many people invest for the sake of it. If you don’t have proper knowledge about the plans your investment offers then you might never really grow your money in it. The better you know an industry or niche, the more likely you’ll be able to spot ideas that could possibly create massive amounts of income for you in the future. No one else is going to do this for you. And when you do invest in something that you know, be sure to track it vehemently.

Multiple source of income but not mainstream.

Anyone who’s serious about getting rich needs to build multiple streams of passive income. Passive income is incredibly important when it comes to amassing wealth. Simply put, you to need to generate your income on autopilot if you want to create a considerable net worth.

There are a number of passive income generating ideas that you could implement. Some of the most popular involve real estate and dividend income for those that can afford the often high-cost barrier of entry into those fields. Others opt for generating passive income by starting a blog, creating digital products such as e-books or courses, and even creating online tutorials, just to name a few examples.

Time Value of Money.

We all have the same amount of time in this world. You don’t have more than the next person and that person doesn’t have more time than another. No matter if they’re a powerful politician, a business magnate or a famous athlete, they don’t have more time than you do. Time is life’s greatest equalizer.

It all depends on how you utilize your time. Every second is precious. Become lazy or procrastinate and lose your dream of being rich.

Rome was not built in a day.

Daily goal setting provides milestones on your way to your bigger goals. Break the big goal down to achievable daily goals that won’t seem so overwhelming. For example, if you want a $10 million dollar net worth in the next five or 10 years, figure out what it’s going to take on a daily basis to move closer to that goal.

Why Dollar is Higher Than Rupee ?

Indian National Rupee and US Dollar are the legal tenders in India and the US respectively. Both USD and INR are accepted in the US and India respectively because they meet following conditions which are necessary for anything to be called as money –

1. General Acceptability

2. Unit of account

3. Store of storage

4. Medium of Exchange

For general acceptability means that no one should refuse from accepting it; unit of account means that is can be used to represent the real value of an economic item; for store of value, it means that if it is stored, it value must not perish; and for medium of exchange, it means that it can be used as a medium for exchange of goods and services.

As the aforesaid conditions are satisfied for Rupee in India and Dollar in the US, both the currencies are used as money in respective countries. However, in international trade when the nations carryout exchange of goods and services among themselves, Rupee lacks the general acceptability while Dollar, Gold, Special Drawing Rights (SRD) of International Monetary Fund (IMF) and some other hard currencies like Euro, Japanese Yen, etc. are accepted by almost all countries as a medium of exchange. Thus dollar becomes the international currency while Rupee remains a currency in India only.

Rupee Vs Dollar

As it is already explained why Rupee is a national currency while Dollar is an international currency, now let’s take a look on the factors which make Dollar stronger than the Rupee.

1. Current Account Deficit

The value of any currency in terms of international currency is determined by the demand and supply of the international currency in a particular country and the demand and supply depends on the nature of Balance of Payments (BOP) of a country. BOP is the foreign trade account divided into two parts – Current Account and Capital Account. All the trade in goods and services and foreign remittances are entered in current account while financial exchanges like loans, or overseas investments, Foreign Direct Investment (FDI) or Foreign Institutional Investment (FII) etc. are the part of capital account. If the value of exports is higher than the value of imports, then their will be a current account surplus and there will be a current account deficit if vice versa.

The export from a country determines the supply of dollar as they will receive dollar from international market for their sold goods and services. Similarly, the imports determine demand of dollar. If imports from a country are higher than the exports from that country, then the demand of dollar will be higher than supply and the domestic currency like Rupee in India, will depreciate against the dollar. Similarly, if exports outpace the imports, then supply of dollar will exceed demand and Rupee will appreciate against dollar in India. In other words, if a country is having current account deficit, the local currency will depreciate against dollar while if it is having a current account surplus, the local currency will appreciate.

In case of India, if BOP account will continue to have a current account deficit, Dollar will continue to overpower the Rupee.

2. Movement Of Capital

Not only just current account but capital account of BOP also determines the value of dollar against a currency. The capital account details the flow of foreign capital in and out of the country. If there is net foreign capital inflow in India in the form of FDI or FII, then the supply of dollar will be much higher than demand and Rupee will strengthen against the dollar. Similarly if there is net capital outflow, Rupee will depreciate.

3. Other Factors

There are several other factors also which determine the supply of dollar into the country. The foreign capital usually flows into the region which provides minimum risk and maximum returns. Higher interest rates in a country suggests higher returns. Therefore whenever Fed Reserve of the US increase the interest rates, there is turmoil in all financial markets across the globe because there is a risk of flight of Dollar back to the US. Since US is the largest economy of the world, it is also minimises the risk. As the risk factor also determines capital movement, most countries give significance to the risk rating by international agencies like Moody’s, Fitch etc. It is because of the risk factor that despite high interest rates in Zimbabwe, most investors ignore it.

And last but not the least, Dollar is an international reserve currency and it is because of this reason, it overpowers most currencies across the world. The strength of US economy vis a vis Indian economy is another reason why Dollar overpowers the Rupee.

Best low-risk Investments in 2020

Due to the Corona Virus Global Pandemic 2020, our economy has faced unprecedented challenges. With businesses shutting down and stocks facing a fall, INVESTORS are looking for stability in their returns by opting for low-risk investment options. Low-risk investments earn only modest or meager returns; and inflation can erode the purchasing power of money stashed in low-risk investments. But it all depends on what your economic requirement is and how much risk you are willing to accept.

Lets dive into the top low-risk Investments in the year 2020.

- High YEILD Savings Accounts.

Savings accounts offer a modest return on your money. A savings account is completely safe in the sense that you’ll never lose money. Most accounts are Government insured up to certain limits, so you’ll be compensated even if the financial institution fails.

- Saving Bonds

Scrictly speaking rather than investments these bonds are more like saving instruments. Bond is a good choice for protection against inflation because you get a fixed rate and an inflation rate added to that every six months.

- Certificate of Deposits

With a CD, the bank promises to pay you a set rate of interest over a specified term if you leave the Certificate of deposits intact until the term ends. Some savings accounts pay higher rates of interest than some CDs, but those so-called high-yield accounts may require a large deposit.

- Money Market Funds

Unlike a CD, a Money market fund is liquid, which means you typically can take out your funds at any time without being penalized. Money market funds usually are pretty safe. The bank tells you what rate you’ll get, and its goal is that the value per share won’t be less than $1.

- Corporate Bonds

Companies also issue bonds, which can come in relatively low-risk varieties (issued by large profitable companies) down to very risky ones. The lowest of the low are known as “junk bonds.” When you buy a corporate bond, you’re loaning money to the company. In return, you receive periodic interest payments until the bond matures and your principal investment is returned.

- Dividend paying stocks

A dividend is a portion of a company’s profits paid out to the company’s shareholders. When a company makes a profit, it can choose to reinvest that profit back into the business, but sometimes it pays a percentage of it back out to shareholders. Not every company pays dividends, but those that do often have slow, reliable growth.

- Preferred Stocks

Preferred stock is more like a lower-grade bond than it is a stock. Still, it may fluctuate substantially if the market falls. Like a bond, preferred stock makes a regular cash payout. But, unusually, preferred stock may be able to suspend this dividend in some circumstances, though often it has to make up any missed payments.

Building an investment portfolio that has at least some less-risky assets can be useful in helping you ride out the volatility in the market, and there’s been no shortage of that this year.

Book Review: Free lancing guide, Pyjama Profit

Vaishali Singh (Cheenu Singh Rathore)

If you want to build an indepebdent free lance career right away then here is the solution, the book Pyjama profit is a free lancing guide, it has the answers of all the questions wandering in your mind whenever you think of this one word ‘freelancing’ grab your copy and start doing what you love to do and get paid for it.

So here is a short and concise review of the book.

The millennial’s guide to a sustainable freelance career, it is the tagline of one of the best selling books on Amazon, ‘PYJAMA PROFIT’ the authors of the book are Varun Mayya and Abhinav Chhikara. The books is all about their journeys from the freelancing to a successful and stable business, the co author of the book Varun Mayya says “Tommorow, if you put me in a strange country without any resources, all I need is a laptop and an internet connection and I know I’ll build myself an awesome life fairly quick.”

Pyjama profit is a modern guide to free lancing. The book talks about the in demand online skills, the different paths one can take to become an expert in specific fields and the freedom that freelancing allows to hone further skills, taking on bigger assignments. A stable income from freelancing was the bedrock that allowed the authors – Varun and Abhinav to pursue their dreams and passions. Now, they have shared their stories of what worked for them and how anyone, anywhere can thrive without being tied to a 9 to 5 job. The book is a perfect fit in today’s time as the freelance economy grows and so do the aspiration among millennials to find a work they love, and not just something that pays their bills.

Your work is your definition

Vaishali Singh (Cheenu Singh Rathore)

Your work is your identity, your work is everything.

I want to tell you that, your work ethics, the way you work is everything, a person is only identified by his or her actions, the things he or she has done, the values he or she has given to the society.

Life is like an illusion, no one has discovered the real meaning of life yet. We don’t even know why the God has created this world, and what is the purpose of life, but one thing I have observed so far is that your words are imperishable even after life, people will remember you by your work ethics by the values you have given to them, by the words you’ve spoken out, and it’s explicit that no matter how intelligent you’re unless you haven’t done anything no one would value your sayings.

A person is not identified by the cast he or she has born in, not by the amount of money he or she earns, not by the brands he or she wears, not by the phone he or she uses, a person is identified by his or her karmas only. There is no scale to measure one’s intelligence, like you can’t judge somebody’s intelligence based upon his or her English speaking skills, language is just a medium of conveying feelings or nothing else.

Now, I am sharing 2 examples down below to convey my message:-

(I) A.P.J. Abdul Kalam :- We always remember him as Missile Man of India, for his work and development of ballistic missile, as a visionary, a hardworking, a pragmatist, a great leader and as a person who has influenced the life of many. We never remember him by his cast, by his face, by the car he used to drive, or by the brand he used to wear.

Let’s take another example of an extremely popular writer named Premchand, he was famous for his modern Hindi- Urdu literature. He is one of the most honoured writer of the Indian subcontinent, and regarded as one of the foremost Hindi writers of early 20th century. Premchand’s writing are very famous till date, as you have definitely read some of his stories in your textbooks, many of the directors filmed Premchand’s stories as series and aired them on television. For your ease let me tell you that he was a very simple man, he never had the most expensive clothes, and a writer named Harishankar Parsai wrote a story named “Premchand ke phate joote” / Premchand’s torn shoes” about him, that story was an irony on Premchand, in which Harishankar Parsai wrote that Premchand was a very grounded and simple man, in the story Harishankar Parsai highlighted Premchand’s personality in a way as he wanted to show that Premchand wasn’t an ostentatious person, in simple words he wasn’t a show off favourite person. Once he got clicked a picture with his wife and in that picture his shoes were torn out, and the writer used that incident as the story he plotted as PREMCHAND’S TORN SHOES, eventhough he didn’t supported him if you will read it in depth you would understand that it was an ironical story, anyway I don’t want to bother you much about Premchand and Harishankar Parsai but my motive of stating it here was to make you understand that your personality builds with your work not with your dressing sense or the things and the stuff you have.

The world will never remember you by the things and stuff you have, people will always remember you by the work you’ve done. – Vaishali Singh.

https://www.pexels.com/photo/man-sitting-on-green-chair-while-using-laptop-374831/

You must be logged in to post a comment.