Bharatanatyam is an Indian classical dance that originated in the Hindu temples of Tamil Nadu and neighbouring areas. Let’s take a look at its history, costumes, and exponents.

Bharatanatyam, a pre-eminent Indian classical dance form presumably the oldest classical dance heritage of India is regarded as mother of many other Indian classical dance forms. Conventionally a solo dance performed only by women, it initiated in the Hindu temples of Tamil Nadu and eventually flourished in South India. Theoretical base of this form traces back to ‘Natya Shastra’, the ancient Sanskrit Hindu text on the performing arts. A form of illustrative anecdote of Hindu religious themes and spiritual ideas emoted by dancer with excellent footwork and impressive gestures its performance repertoire includes nrita, nritya and natya. Accompanists include a singer, music and particularly the guru who directs and conducts the performance. It also continues to inspire several art forms including paintings and sculptures starting from the spectacular 6th to 9th century CE temple sculptures.

History & Evolution

According to the Hindu tradition the name of the dance form was derived by joining two words, ‘Bharata’ and Natyam’ where ‘Natyam in Sanskrit means dance and ‘Bharata’ is a mnemonic comprising ‘bha’, ‘ra’ and ‘ta’ which respectively means ‘bhava’ that is emotion and feelings; ‘raga’ that is melody; and ‘tala’ that is rhythm. Thus, traditionally the word refers to a dance form where bhava, raga and tala are expressed. The theoretical base of this dance form, which is also referred as Sadir, trace back to ancient Indian theatrologist and musicologist, Bharata Muni’s Sanskrit Hindu text on the performing arts called ‘Natya Shastra’. The text’s first complete version was presumably completed between 200 BCE to 200 CE, however such timeframe also varies between 500 BCE and 500 CE. According to legends Lord Brahma revealed Bharatanatyam to the sage Bharata who then encoded this holy dance form in Natya Shastra. The text that consists of thousands of verses structured in different chapters divides dance in two specific forms,namely ‘nrita’ that is pure dance comprising of finesse of hand movements and gestures, and ‘nritya’ that is solo expressive dance that comprises of expressions. According to Russian scholar Natalia Lidova, ‘Natya Shastra’ elucidates several theories of Indian classical dances including that of Tandava dance, standing postures, basic steps, bhava, rasa, methods of acting and gestures.

One of the five great epics of Tamil Literature, ‘Silappatikaram’ (~2nd century CE) has a direct reference to this dance form. The Shiva temple of Kanchipuram that is decorated with carvings dating back to a period between 6th to 9th centuries CE manifests the development of this dance form by around the mid first millennium CE. Many ancient Hindu temples are embellished with sculptures of Lord Shiva in Bharatanatyam dance poses. The eastern gopuram of the 12th century Thillai Natarajar Temple, Chidambaram, of Tamil Nadu dedicated to Lord Shiva bears sculptures depicting 108 poses of Bharatanatyam, referred as karanas in ‘Natya Shastra’, that are intricately carved in small rectangular panels. Another notable sculpture can be seen in the Cave 1 of Karnataka’s Badami cave temples dating back to the 7th century where a 5 feet tall sculpture of Lord Shiva is depicted as Nataraja doing Tandava dance. The 18 arms of the Shiva sculpture expresses mudras or hand gestures that are part of Bharatanatyam.

Association with Devadasi Culture

Originating in Hindu temples of Tamil Nadu and nearby regions, Bharatanatyam soon prospered in other South Indian temples. According to some sources the Devadasi culture dating back to 300 BCE to 300 CE evolved under the auspices of the royals that saw the temple dancers called Devadasis, who were dedicated to serve the Lord as dasis or servants, performing the dance form. Eventually the Devadasi culture became an integral part of rituals in South Indian temples. Although ancient texts and sculptures indicate existence of such culture and presence of dancing girls as also exclusive quarters for women in temple compound, there is no concrete evidence either archaeological or text-based that can manifest the Devadasis as prostitutes or courtesans as accused by some colonial Indologists. After analysing evidences, Davesh Soneji, a historian on performance arts and an expert on Bharatanatyam, concluded that courtesan dancing phenomenon commenced during the Nayaka period of Tamil Nadu sometime around late 16th or 17th century.

Opposition & Ban During Colonial Rule

The 18th century saw emergence of rule of the East India Company followed by setting up of British colonial rule in the 19th century. Such developments saw decline of various classical dance forms which were subjected to contemptuous fun and discouragement including Bharatanatyam that through the 19th century remained exclusive to Hindu temples. Eventually social and economic conditions associated with Devadasi culture added with contempt and despicable attitude from the Christian missionaries and British officials, who held the Devadasis of South India and nautch girls of North India as harlots, disgraced such systems. Furthermore the Christian missionaries launched anti-dance movement in 1892 to stop such practice. The Madras Presidency under the British colonial government banned the custom of dancing in Hindu temples in 1910 and with this the age-old tradition of performing Bharatanatyam in Hindu temples also came to an end.

Revival

The Indian community disapproved such ban. The Tamilians were worried that such a rich and ancient custom of Hindu temple dancing was getting persecuted on the pretext of social reform. Many classical art revivalists like Indian lawyer, freedom-fighter, activist and classical artist E. Krishna Iyer questioned such discrimination. Iyer who became involved with the Bharatanatyam revival movement was incarcerated on charges of nationalism and imprisoned. During his prison term he convinced the political prisoners to advocate for this age-old classical dance form. Iyer founded the ‘Madras Music Academy’ and along with Indian theosophist, dancer and Bharatanatyam choreographer Rukmini Devi Arundale, he strived to save Bharatanatyam from dying out. Despite the fact that Hindu temple dances were being suppressed due to laws enforced by the colonial British government, many artists like American dancer Esther Sherman came from the West to learn Indian classical dance forms. She came to India in 1930 and not only learnt classical dances but also adopted the name Ragini Devi and became a part of the ancient dance arts revival movement. As the Indian freedom movement progressed steadily during the early 20th century, an effort to revive Indian culture and tradition seethed with excitement among Indians. Eminent Bharatanatyam dancers like Arundale and Balasaraswati expanded the dance form out of Hindu temples and established it as a mainstream dance form. Later the Tamil Hindu migrants revived this Hindu temple dancing custom in British Tamil temples during the late 20th century. Today this ancient classical dance form also includes technical performances as also non-religious and fusion based themes.

Repertoire

The repertoire of this performance art are categorized into three brackets namely ‘Nritta’, ‘Nritya’ and ‘Natya’ mentioned in ‘Natya Shastra’ and followed by all major Indian classical dance forms. ‘Nritta’ is a technical performance where the dancer presents pure Bharata Natyam movements emphasising on speed, form, pattern, range and rhythmic aspects without any form of enactment or interpretive aspect. In ‘Nritya’ the dancer communicates a story, spiritual themes, message or feelings through expressive gestures and slower body movements harmonised with musical notes. ‘Natyam’ is usually performed by a group or in some cases by a solo dancer who maintains certain body movements for certain characters of the play which is communicated through dance-acting. The dance form typically comprises of certain sections performed in sequence namely Alarippu, Jatiswaram, Shabdam, Varnam, Padam and Thillana.

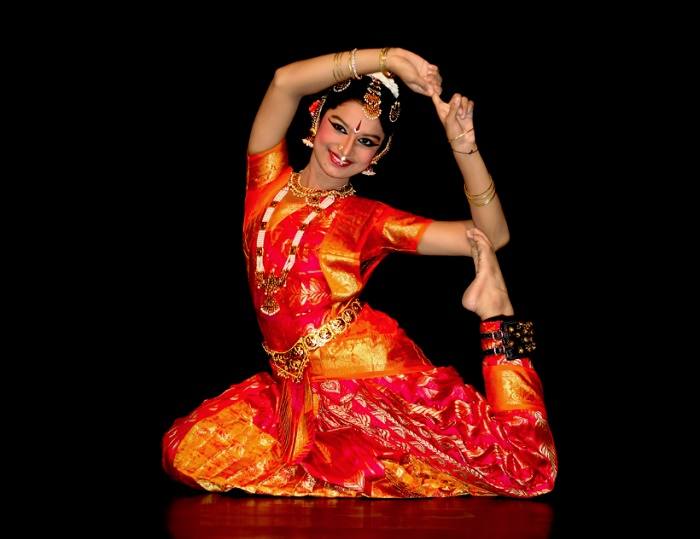

Costumes

The style of dressing of a Bharatanatyam dancer is more or less similar to that of a Tamil Hindu bride. She wears a gorgeous tailor-made sari that consists of a cloth specially stitched in pleats that falls in the front from the waist and when the dancer performs spectacular footwork that include stretching or bending her knees, the cloth widens up like a hand fan. The sari worn in a special manner is well complimented with traditional jewellery that include the ones that adorn her head, nose, ear and neck and vivid face make-up specially highlighting her eyes so that audience can view her expressions properly. Her hair neatly plaited in conventional way is often beautified with flowers. A jewellery belt adorns her waist while musical anklets called ghunghru made of leather straps with small metallic bells attached to it are wrapped in her ankles. Her feet and fingers are often brightened with henna colour so as to highlight gestures of her hands.

Instruments & Music

The Bharatnatyam dancer is accompanied by a nattuvanar (or taladhari) that is a vocalist who generally conducts the whole performance, a part often executed by the guru. The person can also play the cymbals or any other instrument. The music associated with Bharatanatyam is in South India’s Carnatic style and instruments played comprise of cymbals, the flute, a long pipe horn called nagaswaram, a drum called mridangam and veena. The verses recited during performance are in Sanskrit, Tamil, Kannada and Telugu.

Famous Exponents

The four Nattuvanars namely Ponaiyah, Vadivelu, Sivanandam and Chinnaiya who are renowned as Tanjaore Bandhu and who thrived in the Durbar of Maratha ruler, Sarfoji-II from 1798 to 1832 shaped up the modern day Bharatanatyam. Meenakshi Sundaram Pillai, a dance guru from the village of Pandanallur was a noted exponent of Bharatanatyam who is predominantly known for his style referred as the Pandanallur school of Bharatanatyam. One of his students Rukmini Devi championed and performed the Pandanallur (Kalakshetra) style and also remained one of the leading proponents of the classical dance revival movement. Balasarswati who was regarded as child prodigy by Vidhwans and Pandits also joined hands in reviving the dance form. She was a virtuoso of the Thanjavur style of Bharatanatyam. Other imminent Bharatanatyam artists include Mrinalini Sarabhai, her daughter Mallika Sarabhai, Padma Subramanyam, Alarmel Valli, Yamini Krishnamurthy and Anita Ratnam among others.

You must be logged in to post a comment.