Author: Admin

SIVASAGAR: LAND OF HISTORY AND HERITAGE

PLACES TO EXPLORE

NONI: INDIAN MULBERRY

SWEAT EQUITY SHARES

LIFTING OF CORPORATE VIEL

NEW TEHRI: UTTARAKHAND

DOCTORINE OF HOLDING OUT & DOCTRINE OF FEEDING THE GRANT BY ESTOPPLE

DOCTORINE OF HOLDING OUT & DOCTRINE OF FEEDING THE GRANT BY ESTOPPLE

WHAT IS GIFT UNDER TRANSFER OF PROPERTY ACT, 1882

Difference between Private Company, Public Company and One Person Company

PRIVATE COMPANIES

Top 5 tourist places in Odisha

The time when Britain-China clashed over India's Opium -> Opium War 1840

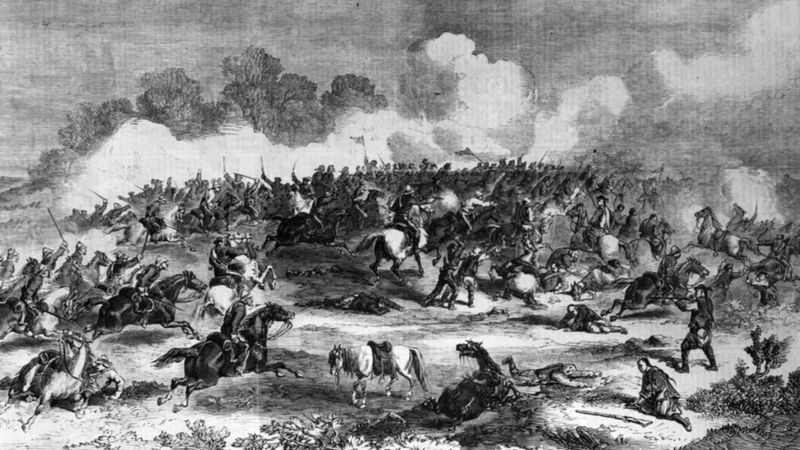

It was in June 1840 when a fleet of British warships went to China’s Pearl River Delta and started war. The security system of China’s coastal areas was weak. China could not last long in front of this British attack and it knelt down.

This was the first Opium War in which thousands of people were killed and that too in the name of free trade. The opium trade in China was a profitable business but it was also illegal. Two Scottish men were involved in this business and both played a major role at the start of the war.

William Jardine was a doctor by profession and also a businessman.

Foreigners were allowed to do business only in this area of China. They used to trade opium instead of tea. There was a great craze for tea in Britain. By the end of the 18th century, Britain was importing 6 million pounds of tea from the canton every year.

Business in Silver :

But soon Britain started facing problems in this business because China’s condition was that it would take only silver as the price of tea. Britain offered things like carved utensils, scientific instruments and woolen cloth as the price of the tea. But China refused to take it.

Qian Long, the then emperor of China, wrote in a letter to King George III, “We have all those things and are of better quality. I do not value such useless things and we have no use for things made in your country.”

Smuggling of Opium :

At least legally it was so. But British businessmen in India saw it as an opportunity. Opium was grown on a large scale in the Bengal region. Although opium was banned in China, opium has been used in Chinese medicine for thousands of years.

Ban in China :

But by the time of the fifteenth century, Chinese people started using it for intoxication by mixing it with tobacco. Soon a large section of Chinese society became addicted to opium and fell into its grip. Its social side effects also started coming to the fore. The victims of opium addiction started selling their valuables for it.

In 1729, Emperor Yongzheng of China completely banned the sale and sale of opium and its use as a drug. But after a hundred years had passed, the craze for opium of the Chinese had not diminished in the slightest and the British started exploiting their addiction.

Eastern Part of India :

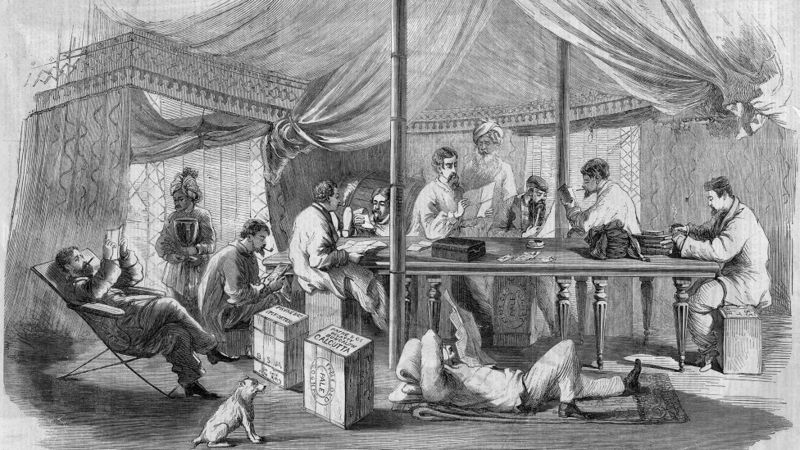

By the year 1836, 30,000 boxes of opium started reaching China every year from India. Jardine, Matheson & Company held a quarter of this business. By breaking the government order banning opium in China, Britain had found a way to increase its income from China.

According to Professor Jan Carroll of the University of Hong Kong, “The British realized that opium is grown in the eastern region of India and that smuggling it into China can make a lot of profit.” And this was made easy for Britain by the coastal position of Canton city of China.

China’s action :

Professor Jan Carroll said, “They easily carried opium in small boats to the shores of the canton. There was always someone there to help them on the shore. From an economic point of view, it was making a lot of profit.”

But breaking the law of Britain in this way did not remain hidden for long. In 1839, Emperor Daoguang of China declared war on drugs. An order was given to launch a raiding campaign against Western businessmen.

British Government :

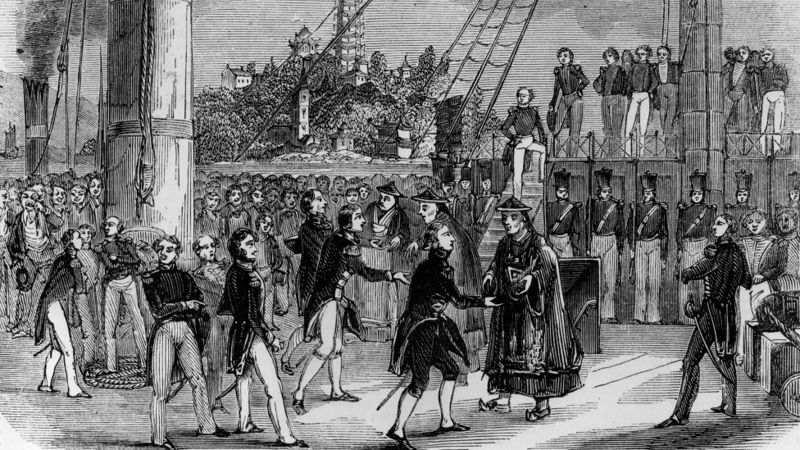

Following this seizure, Pershan left for London from William Jardine Canton, where he pleaded with the British Foreign Minister, Lord Palmerston, to retaliate against China. Opium played a major role in the British’s revenue from India, so it did not take long for the British government to decide to send a navy to China.

China’s Defeat :

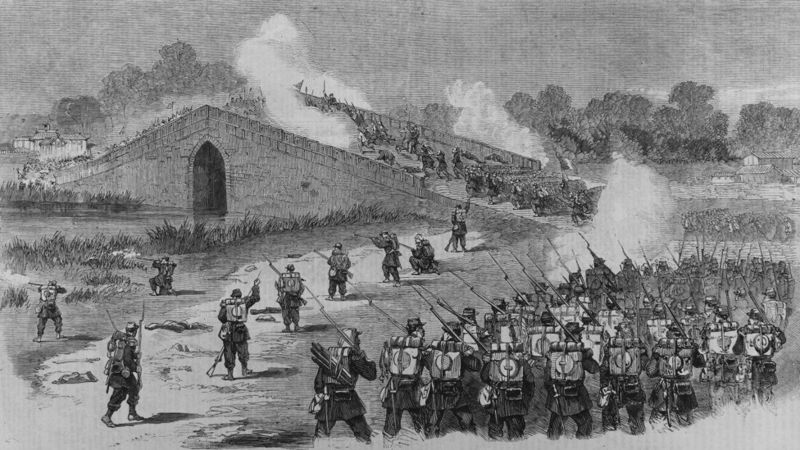

In June 1840, Britain sent 16 warships and 27 ships to China’s Pearl River Delta. There were 4000 people on these ships. The fleet also had the iron warship Nemesis, on which rocket launchers that could be fired up to two miles were stationed.

Although the Chinese were ready for this attack, they did not have the ability to counter the British power. His cannon could last only four to five hours in front of Britain. For the next two years, the British Navy started moving through the Chinese coast towards Shanghai.

Treaty of inequality :

Most of the Chinese soldiers were victims of opium addiction and were defeated everywhere. There were 20 to 25 thousand Chinese casualties in this war while Britain lost 69 soldiers. After this war, China was completely shaken. In August 1842, on HMS Cornwallis near Nanking, the British signed an agreement with the Chinese, which the world knows as the ‘Equal Treaty’ or ‘Treaty of Equality’.

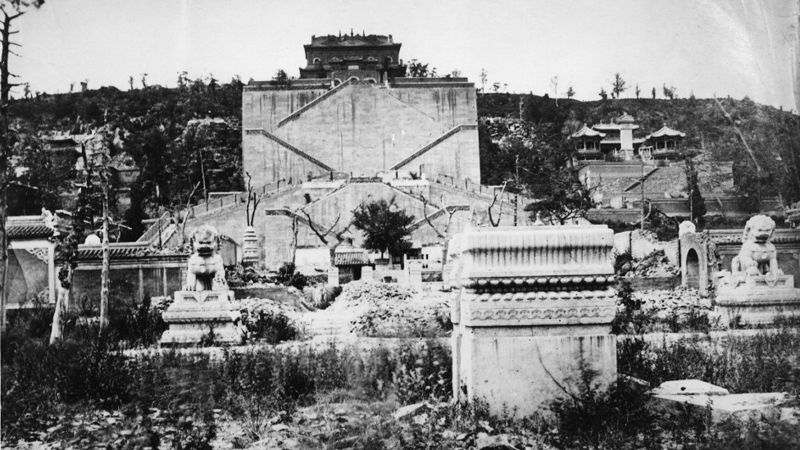

China had to open five ports to foreign trade and paid 201 million silver dollars to Britain as damages caused by the opium trade and the war. Britain got possession of Hong Kong from this treaty, which was to be used to increase the opium trade in China.

Plight of Victim in Criminal Justice System

(Photo: The Daily Guardian)

You want to report,

but that could get your family in danger… And if you snitch on a real gang

leader…. they can get you bad… [The] police don’t have your back unless

you’re like someone on the news or whatever, and they will kind of give you

witness protection. But that doesn’t happen in the real world.

–FEMALE,

SACRAMENTO

The expression

‘victims of crime’ has been defined in section 2 of the code of criminal

procedure, 1973. Initially, the criminal justice system in India was focused on

punishment as part of the crime without much attention on the suffering of

victims of crime. The rights of prisoners were protected even after their

conviction whereas little concern was shown for the rights of victims of crime.

Though there is a wealth of data on victims of reported crime nationally, as

well as various services and programs intending to meet their needs, there

remains a dearth of clear information on how to interrupt cycles of violence

and the persistence vulnerability that keeps such an overwhelming percentage at

high risk of experiencing more crime.

However, with the

emergence of public interest litigation, the higher courts’ attention was drawn

to this lacunae in the existing criminal justice system by social activists,

and the courts started granting compensatory relief to victims of crime, but

comprehensive legislation on this aspect of criminal justice was still awaited.

In recent times, among the many reforms canvassed for improving the criminal justice

system is the one that advocates a victim orientation to criminal justice

administration. Though there are some provisions under the Indian constitution

and some sections in the code of criminal procedure, 1973 to protect the rights

of the victims and for providing compensation, the criminal courts at the lower

level in India have ignored those provisions for a long time and not utilized

them during their sentencing processes.

Victim plays an

important role in the criminal justice system but his or her welfare is not

given due regard by the state instrumentality. Thus, the role of high courts or

the supreme court in our country in affirming and establishing their rights

holds much importance. “Tears shed for the accused are traditional

and trendy but has the law none for the victim of crime, the unknown martyrs“?

This remark by the Hon’ble Justice VK Krishna Iyer aptly describes the plight

of victims in the criminal justice system in our country. The victim is almost

a forgotten entity in the criminal system rather the irony is that the victim

sets the wheel of justice moving by giving information to the state

instrumentalities without which the entire system would collapse.

“Victims

should come first“…

It is of

course an indisputable fact that victims of crime have long been a forgotten

group, a group that suffered for centuries not only from society’s neglect but

also from the exploration of their rightful dias by the state. It is also true

that they had their conflicts stolen by professionals and by the criminal

justice system. However, the exceptional speed with which they were

rediscovered and their cause adopted by the politicians, let alone the

political climate that prevailed at the time of their rediscovery, is bound to

raise questions about the real interests and motives behind what has been

portrayed as a genuinely humanitarian and disinterest cause.

A comprehensive

legal code for victim compensation is a dire necessity. The time has come for

the legislature to stop shirking its duty. Hence, a comprehensive legal code

should be enacted providing for fair treatment, assistance, and adequate

compensation to victims of crime. Only on embarking on this step can justice in

its more altruistic forms be obtained. It should be made mandatory for the

state to pay compensation to the victims of the crime of not only the private

criminal wrongs but also for the criminal acts perpetrated by its agencies.

This mandatory duty of the state gains importance from two points of view

namely as a welfare state committed to the constitutional goal of social

justice and secondly, for its failure to protect the life, liberty, and

security of its citizens.

Therefore, I would

like to conclude with this quote-

“Too

much money…. often resulted in further crimes which were fatal to innocent

victims who need not have been victims if justice had been put first and mercy

second.”

–Agatha Christie

How Psychology has affected my life?

It takes the

innocence out of everything. You don’t see love (or any other feeling) as love

but dig deep to uncover a subconscious need. Of course, that usually turns out

to be true, in which case it worsens the lack of spontaneity. A psychologist

will define it or forever be in pursuit of the meaning behind it. Some people’s

brains are like that. They’re good at it. But nobody likes to be under a

scanner all the time. It’s unnerving.

Psychology softens

one’s understanding of oneself. But the same distance or unattached

empathy has to be maintained to achieve that. At first, psychology and its

study is a way to answer personal conflicts. Studying psychology has affected

and taught me to recognize and check my biases. I used to think that I was fair

and unbiased in how I viewed other people and myself. I have learned about

various psychological errors and biases which made me realize how wrong I was.

Psychology is all

about observing how we behave and why behave that way in every situation of our

life. It changes your way of approaching a problem or situation drastically and

you can find a solution easily to any problem. It changed my way of thinking

and increased my maturity level to better standards. Now I’m able to receive

people as they are without judging them and able to find out the root causes of

my emotional problems and carefully editing my emotions.

It’s an old saying:

“For the world, a psychologist is crazy; for a psychologist, the

whole world is crazy.” This is so true. We consider a psychologist as

a mental. We fail to understand the benefits which we can derive from a

psychologist or simply by studying psychology. In today’s world of rush, it’s

hard to keep yourself calm and your mind in peace. Psychology helps you to deal

with that. So, it is very much needed in today’s world.

They say that

knowledge is power, and indeed it’s true that studying certain subjects gives

you an edge over others, and in life in general. Psychology proved to be one of

those. It helps in inculcating various skills that are relevant in today’s

world. Along with my problem, psychology has helped me in developing five major

skills which are: communication skills, critical thinking skills, insight into

people’s behavior skills, research skills, and understanding skills.

In a nutshell, a

mind is a powerful tool, and psychological insight can hone it into something

invincible. It has the power to change your perspective and outlook. It has the

power to change you into a better person. Studying psychology has proved to be

a blessing for my life and it has affected my life positively.

What's happening in Afghanistan?

Afghanistan is again under the control of the Taliban, a fundamentalist group that ruled the nation for five years before U.S.-led forces ousted them in 2001. Refugees fleeing the group’s ultraconservative brand of Islam have swelled the population of Kabul, the airport has been besieged by Afghans desperate to find a way out, and worries are spreading that the Taliban’s return might encourage Islamist movements elsewhere in Central Asia more than two decades after Osama bin Laden first sought refuge under their protection.

Q1) What is happening in Kabul?

Taliban forces entered the capital of Kabul on Aug. 15, effectively ending a 20-year effort by the U.S. and other Western nations to remodel Afghanistan as a modern democracy. They were buoyed in part by an agreement with the Trump administration in February last year for U.S. forces to leave the country, with President Biden subsequently setting Aug. 31 as the exit date. With Afghan government forces losing air cover and plagued by desertions, the Taliban quickly expanded their footprint before taking the last remaining cities, including Kabul.

Their arrival in the capital sparked panic. Afghans who worked with Western armed forces or agencies rushed to Hamid Karzai International Airport seeking a way out. Western embassies moved their staff to the airport, which is under U.S. military control. In chaotic scenes there, crowds of Afghans ran alongside military transport planes as they prepared for takeoff, with some people trying to cling to the sides of the aircraft. Afghans and Westerners stranded in Kabul trickled into the airport for evacuation, but entry remained difficult, with Taliban fighters manning checkpoints and no clear system to bring people in. On Friday, military personnel fired tear gas to control the crowds trying to get in to board evacuation flights and clear to space for families authorized to leave.

Q2) Why did Afghanistan’s capital fall so quickly?

Afghanistan’s national army and police forces, theoretically numbering 350,000 men and trained and equipped at huge cost by the U.S. and Western allies, were supposed to be a powerful deterrent to the Taliban. They were trained to match the way American forces operate, combining ground operations with air power and using aircraft to resupply far-flung outposts and collect intelligence.

But following Mr Biden’s withdrawal plan, the U.S. pulled its air support, intelligence and contractors servicing Afghanistan’s planes and helicopters. That meant the Afghan military couldn’t function anymore. In many instances, soldiers simply changed out of the uniforms into civilian clothes. Speaking at the White House on Aug. 16, Mr Biden said he stands “squarely behind” his decision to withdraw U.S. troops from Afghanistan, though he acknowledged that the Taliban took control far more quickly than he expected. He cast much of the blame on the Afghan military for failing to take up the fight with the insurgents.

The Taliban have put the three conditions before the people of Afghanistan – Either they accept Sharia law or leave Afghanistan or die. To all the readers of this very article, let’s pray for the safety of the people of Afghanistan.

You must be logged in to post a comment.