Key findings

- Labour Force Participation Rate (LFPR) in urban areas among persons of age 15 years and above has increased from 49.3% during July – September, 2023 to 50.4% in July – September, 2024.

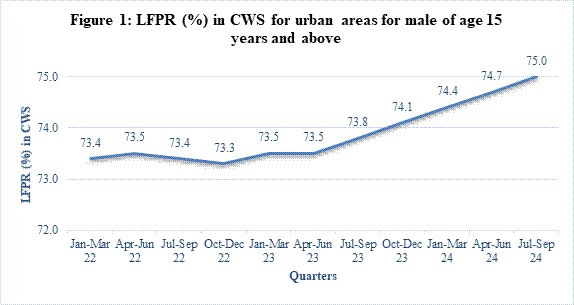

- LFPR for male of age 15 years and above in urban areas increased from 73.8% during July – September, 2023 to 75.0% during July – September, 2024 reflecting overall increasing trend in male LFPR.

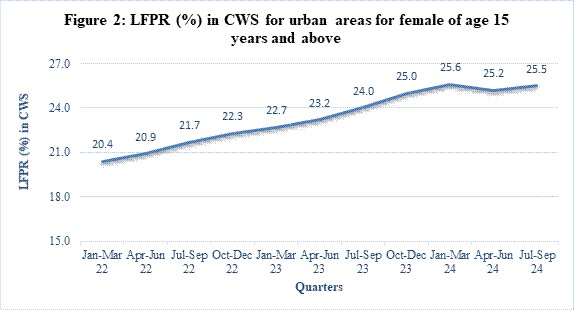

- LFPR among female of age 15 years and above for urban areas increased from 24.0% during July – September, 2023 to 25.5% during July – September, 2024.

- Worker Population Ratio (WPR) in urban areas among persons of age 15 years and above has increased from 46.0% during July – September, 2023 to 47.2% in July – September, 2024.

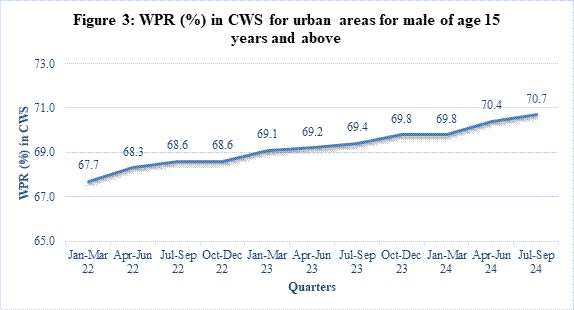

- WPR for male of age 15 years and above for urban areas increased from 69.4% in July – September, 2023 to 70.7% during July – September, 2024 reflecting overall increasing trend in male WPR.

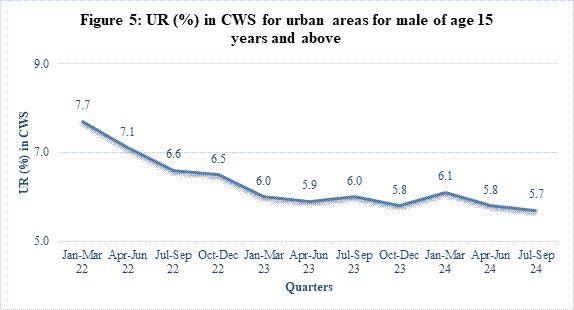

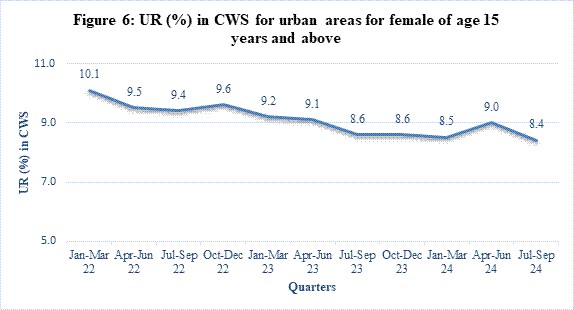

- Unemployment Rate (UR) in urban areas among persons of age 15 years and above decreased from 6.6% during July – September, 2023 to 6.4% during July – September, 2024.

- UR among males of age 15 years and above decreased from 6.0% during July – September, 2023 to 5.7% in July – September, 2024. UR among female of age 15 years and above decreased from 8.6% in July – September, 2023 to 8.4% in July – September, 2024.

A. Introduction

Considering the importance of availability of labour force data at more frequent time intervals, National Statistics Office (NSO) launched Periodic Labour Force Survey (PLFS) in April 2017.

The objective of PLFS is primarily twofold:

- to estimate the key employment and unemployment indicators (viz. Worker Population Ratio, Labour Force Participation Rate, Unemployment Rate) in the short time interval of three months for the urban areas only in the ‘Current Weekly Status’ (CWS).

- to estimate employment and unemployment indicators in both ‘Usual Status’ (ps+ss) and CWS in both rural and urban areas annually.

Twenty-three Quarterly Bulletins of PLFS corresponding to the quarter ending December 2018 to quarter ending June 2024 have already been released. In these quarterly bulletins estimates of labour force indicators, viz., Labour Force Participation Rate (LFPR), Worker Population Ratio (WPR), Unemployment Rate (UR), distribution of workers by broad status in employment and industry of work in the Current Weekly Status (CWS) for urban areas have been presented.

The present Quarterly Bulletin is the twenty-fourth in the series for the quarter July – September, 2024.

PLFS fieldwork during the quarter July – September 2024

The fieldwork for collection of information in respect of all the samples allotted for the period July-September, 2024, were completed timely for the first visit as well as revisit samples, except for 15 first visit FSU[1]s (4 in Maharashtra, 3 each in Manipur and Madhya Pradesh, 2 in Kerala, 1 each in Odisha, Assam and Andaman and Nicobar Islands) and 5 revisit FSUs (2 in Maharashtra and 1 each in Gujarat, Meghalaya and Uttar Pradesh) which were treated as casualty.

These aspects may be kept in mind while using the estimates of PLFS for the concerned quarter.

B. Sample Design of PLFS

A rotational panel sampling design has been used in urban areas. In this rotational panel scheme, each selected household in urban areas is visited four times, in the beginning with ‘First Visit Schedule’ and thrice periodically later with a ‘Revisit Schedule’. The scheme of rotation ensures that 75% of the first-stage sampling units (FSUs) are matched between two consecutive visits.

C. Sample Size

At the all-India level, in the urban areas, a total number of 5,739 FSUs (urban sampling unit curved out from Urban Frame Survey) have been surveyed during the quarter July – September 2024. The number of urban households surveyed was 45,005 and number of persons surveyed was 1,70,598 in urban areas.

- Conceptual Framework of Key Employment and Unemployment Indicators for the Quarterly Bulletin: The Periodic Labour Force Survey (PLFS) gives estimates of key employment and unemployment Indicators like the Labour Force Participation Rate (LFPR), Worker Population Ratio (WPR), Unemployment Rate (UR), etc. These indicators, and ‘Current Weekly Status’ are defined as follows:

- Labour Force Participation Rate (LFPR): LFPR is defined as the percentage of persons in labour force (i.e. working or seeking or available for work) in the population.

- Worker Population Ratio (WPR): WPR is defined as the percentage of employed persons in the population.

- Unemployment Rate (UR): UR is defined as the percentage of persons unemployed among the persons in the labour force.

- Current Weekly Status (CWS): The activity status determined on the basis of a reference period of last 7 days preceding the date of survey is known as the current weekly status (CWS) of the person.

- The Quarterly Bulletin for the quarter July – September 2024 is available at the website of the Ministry (https://mospi.gov.in). The key results are given in the statements annexed.

Annexure

Key Findings of PLFS, Quarterly Bulletin (July – September 2024)

- Labour Force Participation Rate (LFPR) for persons of age 15 years and above

LFPR in urban areas was 50.4% in July – September 2024 for persons of age 15 years in above. While for male LFPR was 75.0% in July – September 2024, for female, LFPR was 25.5% during this period.

| Statement 1: LFPR (in per cent) in CWS in urban areas for persons of age 15 years and aboveall‑India | |||

| survey period | Male | Female | Person |

| (1) | (2) | (3) | (4) |

| July – September 2023 | 73.8 | 24.0 | 49.3 |

| October – December 2023 | 74.1 | 25.0 | 49.9 |

| January – March 2024 | 74.4 | 25.6 | 50.2 |

| April – June 2024 | 74.7 | 25.2 | 50.1 |

| July – September 2024 | 75.0 | 25.5 | 50.4 |

- Worker Population Ratio (WPR) for persons of age 15 years and above

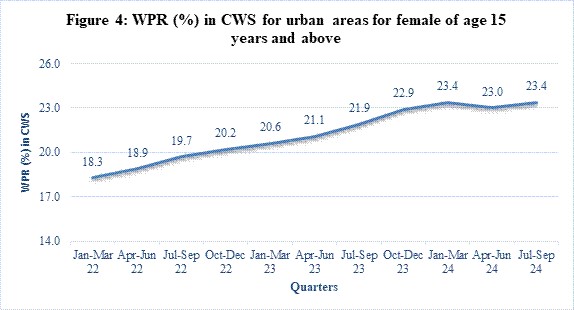

WPR in urban areas was 47.2% in July – September 2024 for persons of age 15 years in above. For male, it was 70.7% in July – September 2024, for female, it was 23.4% during this period.

| Statement 2: WPR (in per cent) in CWS in urban areas for persons of age 15 years and aboveall‑India | |||

| survey period | Male | Female | Person |

| (1) | (2) | (3) | (4) |

| July – September 2023 | 69.4 | 21.9 | 46.0 |

| October – December 2023 | 69.8 | 22.9 | 46.6 |

| January – March 2024 | 69.8 | 23.4 | 46.9 |

| April – June 2024 | 70.4 | 23.0 | 46.8 |

| July – September 2024 | 70.7 | 23.4 | 47.2 |

- Unemployment Rate (UR) for persons of age 15 years and above

Unemployment Rate in urban areas was 6.4% in July – September 2024 for persons of age 15 years in above. For male, Unemployment Rate was 5.7% in July – September 2024 and for female, UR was 8.4% during the same period.

| Statement 3: UR (in per cent) in CWS in urban areas for persons of age 15 years and aboveall‑India | |||

| survey period | Male | Female | Person |

| (1) | (2) | (3) | (4) |

| July – September 2023 | 6.0 | 8.6 | 6.6 |

| October – December 2023 | 5.8 | 8.6 | 6.5 |

| January – March 2024 | 6.1 | 8.5 | 6.7 |

| April – June 2024 | 5.8 | 9.0 | 6.6 |

| July – September 2024 | 5.7 | 8.4 | 6.4 |

E. Highlights of the Quarterly estimates of key Labour Market indicators

- Trend in Labour Force Participation Rate (LFPR) for persons of age 15 years and above since 2022

The trend in LFPR in urban areas since the quarter January – March, 2022 for male and female are presented in figure 1 and 2.

- Trend in Worker Population Ratio (WPR) for persons of age 15 years and above since 2022

The trend in WPR in urban areas since the quarter January – March, 2022 for male and female are presented in figure 3 and 4.

- Trend in Unemployment Rate (UR) for persons of age 15 years and above since 2022

The trend in UR in urban areas since the quarter January – March, 2022 for male and female are presented in figure 5 and 6.

*****

You must be logged in to post a comment.