Indian economy’s financial and banking sectors have shown strong performance despite continuous geopolitical challenges, said the Economic Survey 2023-24 tabled by Union Minister of Finance and Corporate Affairs, Smt. Nirmala Sitharaman in the Parliament today. The survey notes that the Central Bank maintained a steady policy rate throughout the year, with the overall inflation rate under control. The effects of the monetary tightening following the Russia-Ukraine conflict are evident in the lending and deposit interest rates increase among banks. Bank loans saw significant and widespread growth across various sectors, with personal loans and services leading the way.

Monetary Policy

The Monetary Policy Committee (MPC) maintained the status quo on the policy repo rate at 6.5 per cent in FY24. During the current tightening cycle, i.e., from May 2022 to May 2024, the external benchmark-based lending rate and the one-year median marginal-cost-of-funds based lending rate increased by 250 bps and 175 bps, respectively.

Important factors impacting the evolution of monetary and credit conditions during FY24 were the withdrawal of ₹2,000 banknotes (May 2023), the merger of HDFC, a non-bank, with HDFC Bank (July 2023), and the temporary imposition of the incremental CRR (I-CRR) (August 2023).

The growth in Broad Money (M3), excluding the impact of the merger of HDFC with HDFC Bank (with effect from 1 July 2023), was 11.2 per cent (YoY) as of 22 March 2024, compared to 9 per cent a year ago.

During FY24, 17 fortnightly Variable Rate Reverse Repo (VRRR) auctions and seven Variable Rate Repo (VRR) auctions were undertaken as the primary operation. In addition, 49 fine-tuning operations (25 VRRR and 24 VRR) were conducted intermittently, modulating liquidity conditions in alignment with the monetary policy stance, the survey notes.

Bank Credit

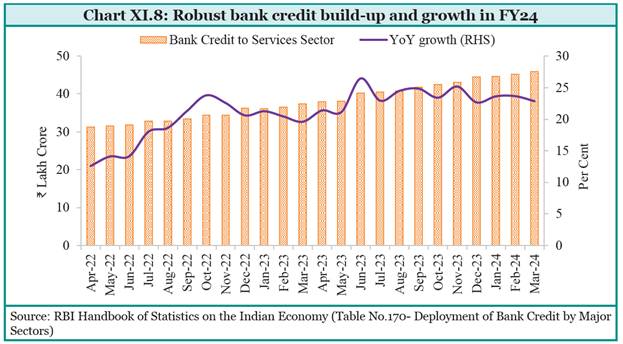

Credit growth remains robust, mainly driven by lending to services and personal loans.

Lending by non-banking financial companies (NBFCs) accelerated, led by personal loans and loans to the industry, and their asset quality improved. Credit disbursal by SCBs stood at ₹164.3 lakh crore, growing by 20.2 per cent at the end of March 2024, compared to 15 per cent growth at the end of March 2023.

Agricultural credit increased nearly 1.5 times from ₹13.3 lakh crore in FY21 to ₹20.7 lakh crore in FY24. The Kisan Credit Card (KCC) scheme played a pivotal role in providing timely and hassle-free credit to farmers, with over 7.4 crore operative KCC accounts at the end of 2023.

Industrial credit growth picked up in H2 of FY24, registering 8.5 per cent growth in March 2024, compared to 5.2 per cent a year ago, driven by an increase in bank credit to small and large industries.

Improving credit flow to the MSME sector at low cost has been a policy priority of the Government and RBI. Bank credit disbursal to the services sector remained resilient despite a slowdown in credit growth to NBFCs Credit disbursal for housing loans increased from ₹19.9 lakh crore in March 2023 to ₹27.2 lakh crore in March 2024.

Banking Sector

There has been a significant enhancement in the asset quality of banks, led by improved borrower selection, more effective debt recovery and heightened debt awareness among large borrowers. In addition to regulatory capital and liquidity requirements, qualitative metrics such as enhanced disclosures, robust code of conduct, and transparent governance structures also improved banking performance.

The gross non-performing assets (GNPA) ratio of SCBs continued its downward trend, reaching a 12-year low of 2.8 per cent at the end of March 2024 from its peak of 11.2 per cent in FY18.

The macro-and micro-prudential measures by RBI and the Government have enhanced risk absorption capacity in recent years, improving the banking system’s stability. For the top 10 Indian banks in asset size, loans constitute more than 50 per cent of their total assets, making banks immune to the rising interest rate cycle.

In the eight years since 2016, 31,394 corporate debtors involving a value of ₹13.9 lakh crore have been disposed of (including pre-admission case disposals) as of March 2024. ₹10.2 lakh crore of underlying defaults were addressed at the pre-admission stage.

The Government has taken several measures to improve the insolvency ecosystem. It has strengthened the NCLT regarding infrastructure, increasing its strength by filling vacancies and proposing an integrated IT platform. The regulations have been amended to keep in line with the needs of the markets and the advances in judicial pronouncements, the survey notes.

Strong Primary Markets

The Survey highlights the remarkable expansion of Indian capital markets. Capital markets have shown impressive results, with India’s stock market capitalisation to GDP ratio ranking fifth globally.

Primary markets remained robust during FY24, facilitating capital formation of ₹10.9 lakh crore (which approximates 29 per cent of the gross fixed capital formation of private and public corporates during FY23), compared to ₹9.3 lakh crore in FY23. Fund mobilisation through all three modes, viz., equity, debt, and hybrid, increased by 24.9 per cent, 12.1 per cent and 513.6 per cent, respectively, in FY24 compared to the previous year.

The number of initial public offers (IPOs) increased by 66 per cent in FY24 from 164 in FY23 to 272 in FY24, while the amount raised grew by 24 per cent (from ₹54,773 crore in FY23 to ₹67,995 crore in FY24). The corporate debt market in India is going from strength to strength. During FY24, the value of corporate bond issuances increased to ₹8.6 lakh crore from ₹7.6 lakh crore during the previous financial year. The number of corporate bonds public issues in FY24 was the highest for any financial year so far, with the amount raised (₹19,167 crore) at a four-year high. Increasing investor demand and the rise in the cost of borrowing from banks have made these markets more attractive for corporates for funding requirements.

Robust Secondary Markets

Indian stock market was among the best-performing markets, with India’s Nifty 50 index ascending by 26.8 per cent during FY24, as against (-)8.2 per cent during FY23. The Survey says that the exemplary performance of the Indian stock market compared to the world can be primarily attributed to India’s resilience to global geo-political and economic shocks, its solid and stable domestic macroeconomic outlook, and the strength of the domestic investor base.

The Indian capital markets have seen a surge in retail activity in the last few years. The registered investor base at NSE has nearly tripled from March 2020 to March 2024 to 9.2 crore as of 31 March 2024, potentially translating into 20 per cent of the Indian households now channelling their household savings into financial markets. The number of demat accounts rose from 11.45 crore in FY23 to 15.14 crore in FY24.

FY24 has been a spectacular year for Mutual Funds as their Assets under Management (AuM) increased by ₹14 lakh crore (YoY growth of 35 per cent) to ₹53.4 lakh crore at the end of FY24, boosted by mark-to-market (MTM) gains and expansion of the industry.

Economic Survey notes that the significant increase in retail investors in the stock market calls for careful consideration as there is the possibility of overconfidence leading to speculation. It says that the firms operating in banking and capital markets must keep the interests of the consumers in mind through fair selling, disclosure, transparency, reliability, and responsiveness.

Progress of financial inclusion

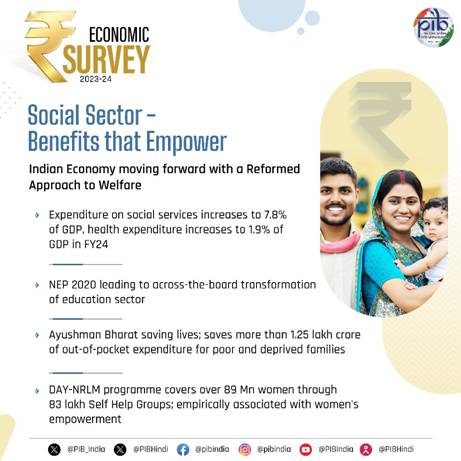

The Survey highlights that the Government has prioritised delivering financial services to the last mile. The number of adults with an account in a formal financial institution increased from 35 per cent in 2011 to 77 per cent in 2021. Not only there is a decline in the access gap between the rich and the poor but the gender divide in terms of financial inclusion has also narrowed.

Survey notes a shift in focus of the financial inclusion strategy in the country, from ‘every household’ to ‘every adult,’ with added emphasis on direct benefit transfer (DBT) flows, promoting digital payments using RuPay cards, UPI123 etc.

Highlighting the progress of financial inclusion so far in the country, the survey says that India is among the fastest-growing fintech markets in the World, hailing as the third-largest growing fintech economy. A key enabler of this financial inclusion drive has been the digitalisation of the financial system, which the survey terms “transformative”. ‘Digital financial inclusion (DFI)’ is the next big target of the government. The survey says that the COVID-19 pandemic gave further momentum to Digital financial inclusion (DFI) when the most vulnerable and excluded citizens were severely affected. Some flagship schemes such as the Digital India Mission, Make-in-India, Aadhaar, e-KYC, Aadhaar-enabled Payment System, UPI, Bharat QR, DigiLocker, e-sign, Account Aggregator, Open Network for Digital Commerce, etc came to the rescue.

The success of UPI has been enhanced by the expansion of smartphone usage in India, with more than 116.5 crore smartphone subscribers as of 31 March 2024. The value of transactions conducted on the UPI platform has increased multifold from ₹0.07 lakh crore in FY17 to ₹200 lakh crore in FY24.

Microfinance has been playing an essential role in meeting low-income households’ credit needs by providing affordable doorstep services. Globally, the Indian microfinance sector is the second largest after China in terms of number of borrowing customers in India, which are about three times that of the next biggest market, i.e., Indonesia.

Insurance sector

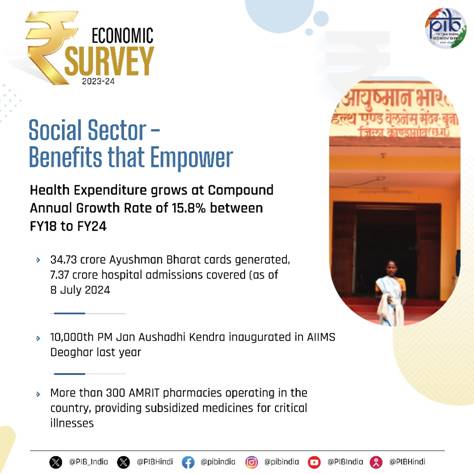

The survey says that the insurance sector has seen a remarkable growth. India is poised to emerge as one of the fastest-growing insurance markets in the coming decade. Economic growth, an expanding middle class, innovation, and regulatory support have driven insurance market growth in India. Non-life premium growth moderated slightly from 9 per cent in FY22 to an estimated 7.7 per cent in as the market stabilised after the pandemic. Recently, Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) achieved a milestone of generating 34.2 crore Ayushman cards across India, with 49.3 per cent of them held by females.

Pension sector

Talking about the developments in the pension sector, the survey states that India’s pension sector has expanded since the introduction of the National Pension Scheme (NPS) and, more recently, the Atal Pension Yojana (APY). The total number of subscribers stood at 735.6 lakh as of March 2024, registering a YoY growth of 18 per cent from 623.6 lakh as of March 2023. The total number of APY subscribers (including its earlier version, NPS Lite) increased from 501.2 lakh as of March 2023 to 588.4 lakh as of March 2024. APY subscribers account for around 80 per cent of the pension subscriber base. APY subscribers have witnessed an improvement in gender mix, with female subscriber share rising from 37.2 per cent in FY17 to 48.5 per cent in FY23.

The survey also mentions the mechanisms to ensure regulatory coordination and overall financial stability, which should withstand unforeseen shocks so that there is a high degree of confidence. It recognizes the key role of Financial Sector Development Council (FSDC) to deal with a wide range of issues relating to financial stability and financial sector development.

*****

You must be logged in to post a comment.