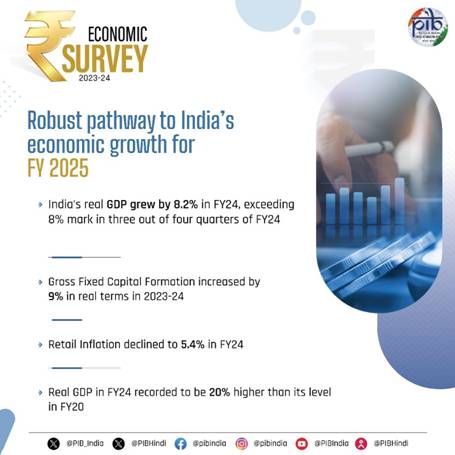

The Economic Survey 2023-24, that was tabled in Parliament today, lays special emphasis on controlling Prices and Inflation as ‘Low and stable inflation is key to sustaining economic growth.’ It states that Governments and Central Banks face the challenge of keeping inflation at a moderate level while ensuring financial stability. Achieving this delicate balance requires careful monitoring of economic indicators and taking appropriate and timely corrective actions. With the commitment of the Reserve Bank of India (RBI) to the goal of price stability and policy actions by the Central Government, India has successfully managed to keep retail inflation at 5.4 per cent in FY24, the lowest level in 4 years, since the Covid-19 pandemic period.

The Economic Survey highlights the fact that India’s retail inflation is lower than the emerging markets & developing economies (EMDES) and world average in 2022 and 2023 as per IMF data. Survey states that factors such as established monetary policies, economic stability, well-developed and efficient markets that balance supply and demand conditions, and stable currencies contribute to the effective management of inflation. Historically, inflation in advanced economies has generally been lower than in EMDEs.

Inflation Management

With the goal of maintaining price stability, many countries have established their own inflation targets based on various factors that serve their economic objectives best. Lauding India’s Inflation Management, the Economic Survey states that interestingly, India is performing better than various developed and emerging economies in relation to its inflation target. In 2023, India’s inflation rate was within its target range of 2 to 6 per cent. Compared to advanced economies like the USA, Germany, and France, India had one of the lowest deviations from its inflation target in the triennial average inflation from 2021-2023. Despite the challenges posed by global demand- supply imbalances due to ongoing geopolitical tensions, India’s inflation rate was 1.4 percentage points below the global average in 2023.

Since 2020, countries have been facing challenges in controlling inflation. India has been able to bring about a declining trend in Headline and Core Inflation through its prudent administrative measures and monetary policy. As per the Economic Survey, since May 2022, monetary policy broadly focused on absorbing excess liquidity in the system by increasing the policy repo rate by 250 basis points from 4 per cent in May 2022 to 6.5 per cent in February, 2023. Thereafter, the policy rate was kept unchanged by focusing on the gradual withdrawal of accommodation, aiming to align inflation with the target, while simultaneously fostering growth. Consequently, the persistent and sticky core inflation observed in FY23 declined to 3.1 per cent in June, 2024

The Survey further asserts that administrative measures such as price cuts for LPG, petrol, and diesel led to lower LPG and petroleum product inflation. LPG inflation rate has been in the deflationary zone since September 2023 while retail inflation in petrol and diesel moved to the deflationary zone in March 2024. Additionally, global commodity prices declined in 2023, reducing price pressure in energy, metals, minerals, and agricultural commodities through the imported inflation channel. Low fuel and core inflation ensured a downward trajectory for headline inflation, despite volatility in food prices in FY24. As per the recent data released by MoSPI, the retail inflation rate was 5.1 per cent in June 2024.

Core inflation, measured by excluding food and energy items from CPI headline inflation has witnessed a four year low in FY24. From the pandemic-driven highs, inflationary pressures in India eased in FY22, aided by softening food inflation. Inflationary pressures firmed up in FY23 yet again driven by the Russia-Ukraine war disrupting the recouping supply chains leading to a rise in food and fuel prices. In FY24, the price situation improved. CPI inflation moderated, driven by a decline in core inflation in both goods and services. Core services inflation eased to a nine-year low in FY24; at the same time, core goods inflation also declined to a four-year low.

Trends in core inflation are important in determining the contours of monetary policy. Assessing the emerging patterns of price pressures, the RBI increased the repo rate gradually by 250 basis points since May 2022 to curtail inflationary pressures, leading to reduction of around 4 percentage points in core inflation between April 2022 and June 2024. This was aided by moderation in housing rental inflation, with a significant increase in the stock of new houses in 2023.

Consumer durables inflation increased progressively between FY20 and FY23 by more than 5 percentage points, mainly due to increase in gold prices in FY21 and clothing in FY22 and FY23. With the improvement in the supply of key raw materials, the inflation rate for consumer durables declined in FY24. However, record-high gold prices, driven by anticipated Fed rate cuts and escalating geopolitical uncertainty, have exerted upward pressure on overall durables inflation. Consumer non-durables (CND) inflation plunged in FY20, it started to inch up in FY21, reached an all-time in FY22, and declined sharply in FY23 and FY24.

Food Inflation has been a global phenomenon in the last two years. Research indicates the rising vulnerability of food prices to climate change. In FY23 and FY24, the agriculture sector was affected by extreme weather events, lower reservoir levels, and damaged crops that adversely affected farm output and food prices. So, food inflation based on the Consumer Food Price Index (CFPI) increased from 3.8 per cent in FY22 to 6.6 per cent in FY23 and further to 7.5 per cent in FY24. However, the government took prompt actions, including open market sales, retailing in specified outlets, and timely imports, to ensure an adequate supply of essential food items. Additionally, to ensure food security for the poor, the Pradhan Mantri Garib Kalyan Anna Yojana, which provides free food grains to more than 81 crore beneficiaries, was extended for a period of five years starting from January 2024.

Global Food Prices and Domestic Inflation

Global food prices also have an impact on domestic inflation. In India, the edible oil market is heavily depends on imports, with more than 50 per cent of the total edible oil requirement being imported, making it sensitive to global prices. The Government closely monitors global market trends to ensure the availability of edible oils for consumers at an affordable price. Efforts are also made to balance imports with domestic production to mitigate the risks associated with global price volatility. In this context, the National Mission on Edible Oils Oil Palm aims to increase domestic crude palm oil production to reduce the import burden. In the case of sugar, the Government announced restrictions on export in June 2022 to ensure sufficient local supplies and thereby manage sugar inflation. These export restrictions have indeed played a role in stabilising domestic sugar prices. As a result, even though the global sugar price index inflated and has been showing volatility since February 2023, domestic sugar prices have remained much less volatile.

Elaborating on the Interstate variations in Retail Inflation, the Economic Survey asserts that inflation rate was less than 6 per cent in 29 out of the 36 States and Union Territories. These Interstate variations in inflation are more pronounced in rural areas since rural consumption basket has a much higher weightage of food items (47.3%) than the urban (29.6%). Hence, in the last two years, States that witnessed elevated food prices also experienced higher rural inflation.

Future Inflation Projections

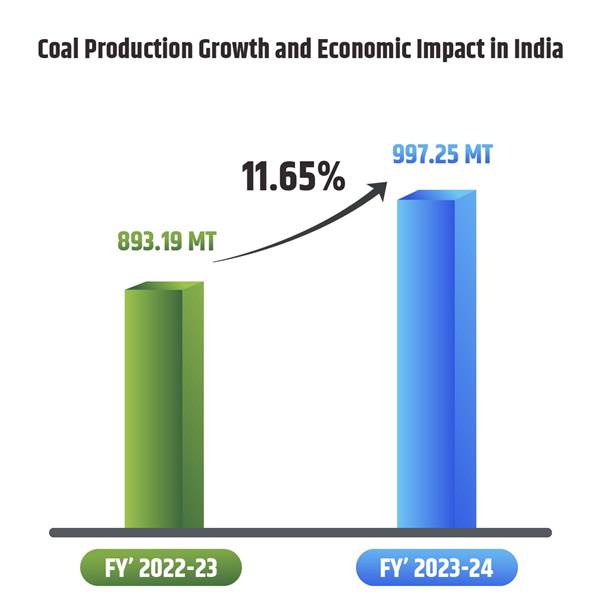

RBI and IMF have projected India’s consumer price inflation will progressively align towards the inflation target in FY26. Assuming a normal monsoon and no further external or policy shocks, the RBI expects headline inflation to be 4.5 per cent in FY25 and 4.1 per cent in FY26. IMF has projected an inflation rate of 4.6 per cent in 2024 and 4.2 per cent in 2025 for India. The World Bank expects that the global supply of commodities will increase, and so will their demand due to improved industrial activity and trade growth. It projects a 3 per cent decline in the commodity price index in 2024 and a 4 per cent decrease in 2025, mainly driven by lower energy, food and fertiliser prices. The energy price index is expected to reduce due to significant declines in coal and natural gas prices this year. Fertiliser prices are likely to weaken but remain above 2015-2019 levels due to strong demand and export restrictions. Base metal prices are projected to rise, reflecting increased global industrial activity and clean energy production. In general, the current downward movement in the prices of commodities imported by India is a positive for the domestic inflation outlook.

The short-term inflation outlook for India is benign. However, from the angle of long-term price stability, the Economic Survey suggests exploring the following options as the way forward:

1. Reducing import dependence for edible oils by increasing domestic production of major oilseeds, Exploring potential of non-conventional oils such as rice bran oil and corn oil and expanding scope of National Mission on Edible Oils

2. Expand the area under pulses, particularly lentils, tur, and urad, in more districts and rice- fallow areas. Promoting the summer cultivation of urad and moong in areas with assured irrigation facilities.

3. Further improving and developing modern storage and processing facilities for vegetables, especially tomatoes and onions.

4. Improving swiftness and effectiveness of administrative action by the Government to deal with price flare-ups in specific items by collating high-frequency price monitoring data, from the farm gate to the final consumer, in a quantifiable manner. Expediting producer price index for goods and services for better grasp on episodes of cost-push inflation and

5. Revising the consumer price index with fresh weights and item baskets using Household Consumer Expenditure Survey, 2022-23.

*****

You must be logged in to post a comment.